1. At a Glance – Blink and You’ll Miss the Margins

Kritika Wires Ltd is currently trading at ₹6.54, with a market cap of ~₹174 Cr, and the stock looks like it has personally offended Mr. Market. Over the last 3 months it is down ~20%, 6 months ~24.5%, and 1 year ~34.4%. Meanwhile, the business quietly posted ₹161 Cr revenue in Q3 FY26, PAT of ₹1.63 Cr, and an OPM of 1.76% — which is not thin, it’s anorexic.

This is a power transmission–linked steel wire manufacturer doing nearly ₹787 Cr TTM sales but barely squeezing out ₹9 Cr PAT. Think of it as a heavy lifter who refuses to eat protein.

Valuation-wise, the stock trades at ~19x earnings, 1.8x book, EV/EBITDA ~9.3x, with ROCE ~15% and ROE ~11%. Debt stands at ₹38–39 Cr, not scary, but not gym-fit either. Promoters hold ~63.3%, with zero pledge, though their stake has declined over the years.

So the obvious question:

👉 How does a company sell ₹160 Cr per quarter and still struggle to cross ₹2 Cr profit?

That, dear reader, is today’s mystery.

2. Introduction – The Curious Case of High Sales, Low Self-Esteem

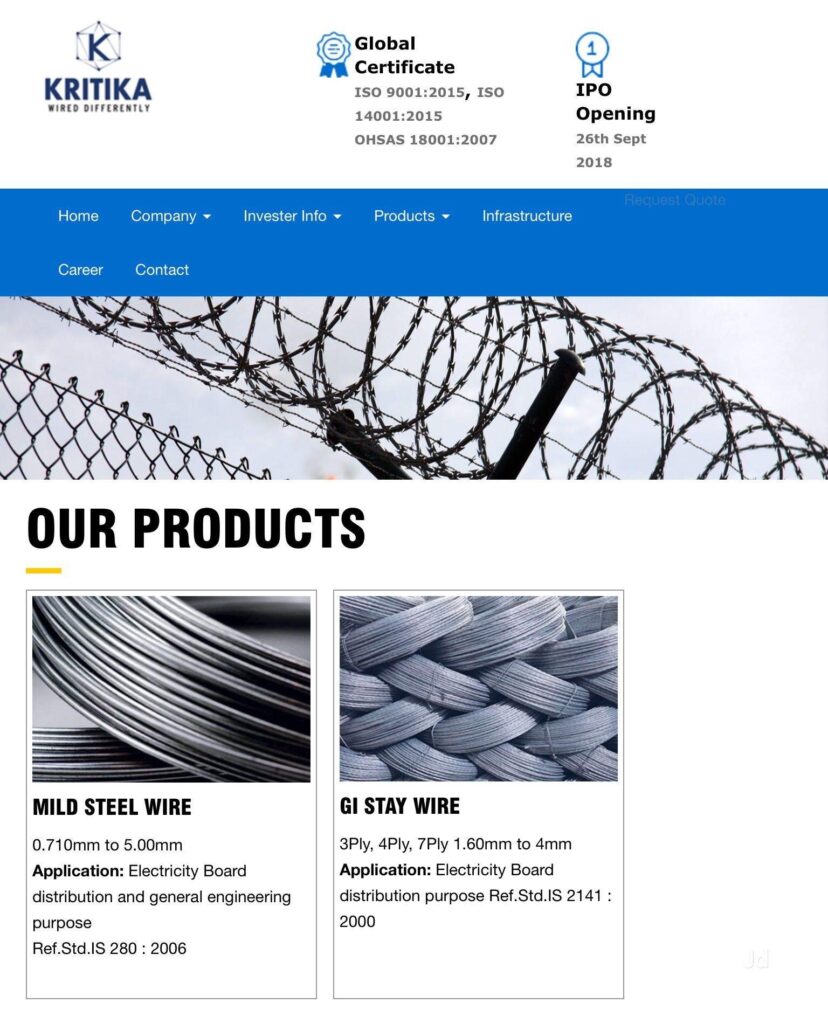

Kritika Wires Ltd (KWL) was incorporated in 2004 and is part of the Jai Hanuman Group. On paper, it looks solid: ISO-certified, long-standing clients like PowerGrid, Tata Projects, Kalpataru, Voltas, and a manufacturing base in Howrah with 66,200 MTPA capacity.

This is not a fly-by-night operation. It sells steel wires, galvanized wires, ACSR core wires, and other products that literally hold up India’s power infrastructure. These are not optional items. If electricity flows, Kritika probably supplied something along the way.

Yet, despite being in a boring but essential business, Kritika’s profitability behaves like a seasonal guest — shows up occasionally, never stays long.

The company scaled revenues aggressively:

- FY22 sales: ₹244 Cr

- FY23 sales: ₹282 Cr

- FY24 sales: ₹432 Cr

- FY25 sales: ₹745 Cr

- TTM: ₹787 Cr

That’s a CAGR most startups would kill for.

But profits? Meh.

So what’s going on here?

- Commodity pricing pressure?

- Margin-less PSU contracts?

- Overdependence on volume growth?

- Or just chronic low bargaining power?

Let’s peel this onion carefully — because there are tears involved.

3. Business Model – WTF Do They Even Do?

Kritika Wires manufactures industrial steel and galvanized wires, mainly used in:

- Electricity transmission

- Cables & conductors

- Infrastructure electrification

- Industrial applications

Product list includes:

- Mild steel wires

- GI stay wires

- ACSR core wires & strands

- PC strands

- Barbed wire

- Spring steel wire

- Rolling shutter wire

Basically, if it’s metallic, stretched, twisted, and sold by weight — Kritika is interested.

The Business Reality

This is a volume-driven, low-margin, price-taker business.

Most clients are:

- Government entities

- PSU-linked contractors

- EPC players

Translation:

👉 Margins are negotiated by people who enjoy squeezing suppliers.

Export contribution is just ~1%, so there’s no FX magic or global premium. 99% domestic, mostly infrastructure-linked demand.

The company doesn’t own brands. It owns machines, metal, and patience.

Question for you:

👉 In a business where steel price moves faster than WhatsApp forwards, who really controls margins?

4. Financials Overview – Numbers Don’t Lie, They Just Whisper

Quarterly Comparison (₹ Cr)

| Metric | Latest Qtr (Dec’25) | YoY Qtr (Dec’24) | Prev Qtr (Sep’25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 161.13 | 178.93 | 179.63 | -9.95% | -10.3% |

| EBITDA | 2.83 | 2.87 | 5.02 | -1.4% | -43.6% |

| PAT | 1.63 | 2.12 | 1.14 | -23.1% | +43.0% |

| EPS (₹) | 0.06 | 0.08 | 0.04 | -25.0% | +50.0% |

Annualised