1. At a Glance – When Sugar Gives You Diabetes, But Litigation Gives You Glucose

Kothari Sugars & Chemicals Ltd (KSCL) is one of those companies that has been around so long that your grandfather probably invested in it, forgot about it, and then checked it again only to sigh deeply. Incorporated in 1961, KSCL operates two sugar units in Tamil Nadu (Kattur and Sathamangalam), along with a distillery and co-generation power setup. Sounds diversified? Yes. Sounds profitable? That’s… complicated.

As of early February 2026, the stock trades around ₹25–26, with a market cap of roughly ₹214 crore. Book value stands taller at about ₹34, meaning the stock is chilling below book, wearing a “value stock” tag it didn’t exactly earn recently. The last one-year return is a painful -38%, and three-year returns are still in the red. ROCE is a modest ~3%, ROE is even more shy at ~1.7%. Debt is relatively controlled at ~₹49 crore with a debt-to-equity of ~0.17, so at least the balance sheet isn’t screaming for help.

Now the spicy bit: Q3 FY26 (Dec 2025 quarter) delivered ₹70 crore of sales and a PAT of about ₹12 crore. Sounds nice, until you realise a big chunk came from an exceptional reversal of old litigation provisions worth nearly ₹1,977.78 lakh. Translation: the courts were kinder than the sugar cycle.

So is KSCL waking up? Or is this just legal glucose giving a temporary energy spike? Let’s dig in.

2. Introduction – A 60-Year-Old Sugar Company with Mood Swings

Sugar companies are like Indian monsoons—cyclical, unpredictable, and everyone pretends they understand them. KSCL is no exception. Over the last decade, revenues have swung wildly, margins have danced between respectable and embarrassing, and investors have learnt patience the hard way.

KSCL’s core business revolves around sugar manufacturing, distillery operations (alcohol/ethanol), and power generation from bagasse. In theory, this is the holy trinity of sugar economics: crush cane, make sugar, divert molasses to ethanol, burn bagasse for power. In practice, it depends heavily on government pricing, state policies, ethanol blending programmes, cane availability, and the occasional court judgment.

FY23 looked relatively decent operationally: higher cane crushing, stable recovery rates, and increased alcohol production. But FY24 and FY25 reminded everyone that sugar is not a consumer staple—it’s a regulated commodity with political mood swings.

The company’s recent quarters show volatile operating margins, negative operating profits in some quarters, and PAT oscillating between red and green. And just when you think you’ve figured the trend, an exceptional item walks in like a Bollywood plot twist.

So before we get excited or depressed, let’s first answer the most basic question.

3. Business Model – WTF Do They Even Do?

Imagine you own sugarcane farms, a distillery, and a power plant, all glued together by government notifications. That’s KSCL.

Sugar

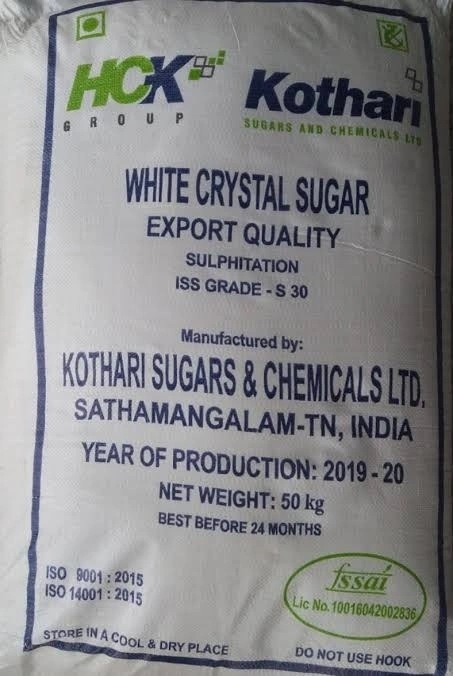

KSCL crushes sugarcane at its two units with a combined crushing capacity of ~6,400 TPD. In FY23, the company crushed about 10.88

lakh tonnes of cane and produced around 10.39 lakh quintals of sugar, with recovery hovering around ~9.6%. Not stellar, not terrible—very Tamil Nadu sugar belt average.

Sugar contributes the bulk of revenue (about 62% in 9M FY24). But it’s also the most volatile segment, thanks to controlled sugar prices, rising cane costs, and inventory cycles. When sugar prices behave, KSCL looks okay. When they don’t, margins evaporate faster than ethanol in an open beaker.

Distillery / Alcohol

This is the segment everyone watches with hope. KSCL produced ~178 lakh litres of alcohol in FY23. The distillery has a capacity of 60 KLPD and participates in the ethanol blending programme by supplying to oil marketing companies.

In theory, ethanol should be the saviour. In reality, execution has been uneven. Supplies to OMCs have happened, but volumes haven’t yet transformed the P&L the way investors dream about. Still, this segment contributes ~20% of revenue and carries better margin potential than sugar.

Power (Co-generation)

KSCL generates power using bagasse, producing ~88 million units in FY23. Part of this is sold under long-term PPAs (notably with TANGEDCO at ~₹4.67/unit), and part via open access/IEX.

This segment contributes ~18% of revenue. Margins depend on tariffs, plant utilisation, and—yes—regulatory clarity. Power is steady but not exciting, like a fixed deposit that sometimes forgets to pay interest on time.

Put together, KSCL is diversified—but diversification doesn’t automatically mean profitability. It just means losses can come from multiple directions.

4. Financials Overview – The Table That Tells You Why Sugar Is a Headache

Quarterly Comparison Table (₹ Crore, Standalone)

| Metric | Latest Qtr (Dec FY26) | YoY Qtr (Dec FY25) | Prev Qtr (Sep FY26) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 70.1 | 83.0 | 68.0 | -15.5% | +3.1% |

| EBITDA | -6.0 | 3.0 | -8.0 | NA | NA |

| PAT | 12.0 | 5.0 | -7.0 | +140% | NA |

| EPS (₹) | 1.44 | 0.65 | -0.87 | +122% | NA |

Witty commentary:

Revenue is still sulking YoY. EBITDA is negative because operations are allergic to consistency. PAT, however, looks heroic—thanks largely to exceptional reversals. This is like losing money every month but suddenly winning a court case and throwing a party.

Annualised EPS