1. At a Glance

Welcome to the corporate circus where white coats meet red tape — Dr. Reddy’s Laboratories Ltd (NSE: DRREDDY), the ₹1.07 lakh crore pharma behemoth that makes painkillers for your bodyandyour portfolio. As of Q2FY26, the company clocked revenues of ₹8,805 crore and net profits of ₹1,437 crore. The stock’s been playing slow garba around ₹1,280, moving just 0.45% in the last three months while Sun Pharma is already dancing bhangra at ₹1,700+.

Despite USFDA’s love letters (Form 483s at Mirfield, Bachupally, and Srikakulam), Dr. Reddy’s delivered yet another consistent quarter — proving once again that compliance issues are just mild spice in its Hyderabad biryani of global generics. ROE stands at 18%, ROCE 22.7%, and debt-to-equity at a trim 0.14.

Oh, and they spent ₹4,464 million to acquire STUGERON® from Janssen, because apparently, one more anti-vertigo drug was what this planet desperately needed.

So, is Dr. Reddy’s the calm surgeon of India’s pharma chaos, or just the most polite troublemaker in the FDA’s inbox? Let’s dissect.

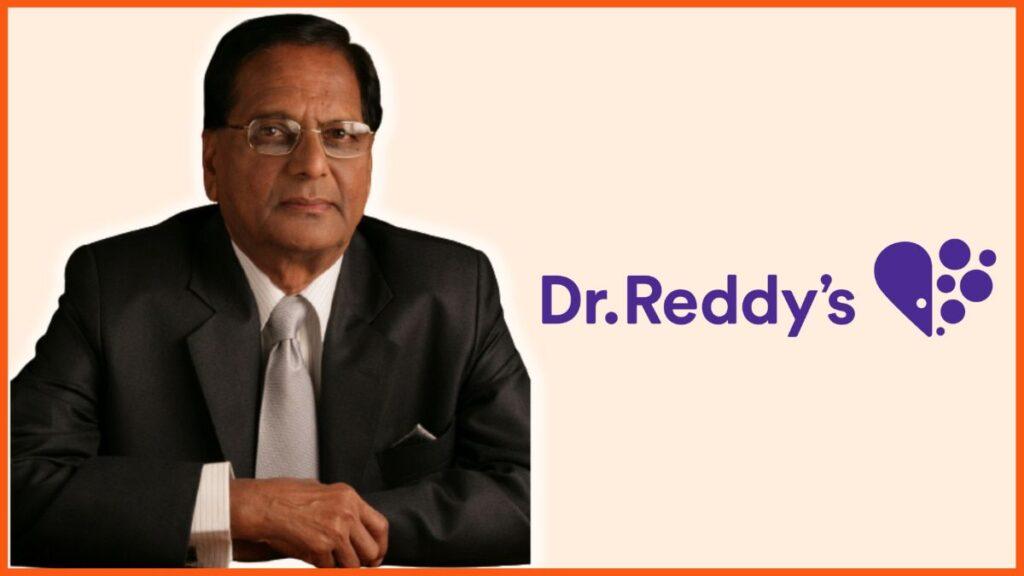

2. Introduction

Dr. Reddy’s is that overachieving cousin who tops every exam, collects foreign approvals like stamps, and still gets detention once every semester. Founded in 1984, the company grew from making APIs for others to becoming one of the most vertically integrated global generic machines, with a presence in 60+ countries and 23 factories scattered from Hyderabad to Mexico.

If Sun Pharma is the Salman Khan of Indian pharma (flashy, controversial, but unstoppable), Dr. Reddy’s is Aamir Khan — disciplined, research-obsessed, slightly self-righteous, and very fond of “method acting” through R&D.

Its empire now covers everything — generics, APIs, biosimilars, contract manufacturing, and those elusive “differentiated formulations” that sound fancy but are often just smart packaging and patient-friendly dosages.

But FY26 has not been entirely chill. The quarter came with a cocktail of good revenue, new acquisitions, FDA heat, tax reassessment notices, and a HR musical chair (new CHRO in, old CHRO out). The irony? Their own stress-relief medicine portfolio must be booming.

Question: if you could export one Indian product to the US that’s always in short supply, would you pick generic drugs or patience?

3. Business Model – WTF Do They Even Do?

Dr. Reddy’s is basically the Amazon of chemicals — if it’s white, powdery, and has a molecule name ending with “-ine,” chances are they sell it. The business is divided into three main segments:

- Global Generics (~83% of revenues)– The bread and butter. Over 400 generic formulations across therapy areas — from nervous system drugs (14% share) to anti-infectives (10%) and GI treatments (13%). In the US, they file ANDAs faster than influencers launch startups.

- Pharmaceutical Services & Active Ingredients (PSAI) (~14% of revenues)– This is where they cook the raw material that other pharma giants buy. Think of it as the “tandoor” where other people’s biryanis are half-cooked. With 139 DMFs filed worldwide in FY22, Dr. Reddy’s is the API kingpin.

- Proprietary Products & Others (~2% of revenues)– The “start-up child” of the family — small but full of ambition. Here lies Aurgene Discovery, their biotech arm working on cancer and inflammation drugs. It’s like a PhD student — lots of promise, little profit (for now).

The secret sauce: vertical integration. They make APIs for their own generics, cutting costs and launch time. It’s like growing your own vegetables and then selling the salad at 10x the price.

4. Financials Overview

| Metric (₹ Cr) | Latest Qtr (Sep 2025) | YoY Qtr (Sep 2024) | Prev Qtr (Jun 2025) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 8,828 | 8,038 | 8,572 | 9.8% | 3.0% |

| EBITDA | 2,010 | 2,076 | 2,174 | -3.2% | -7.6% |

| PAT | 1,337 | 1,342 | 1,410 | -0.4% | -5.2% |

| EPS (₹) | 16.1 | 15.1 | 17.0 | 6.8% | -5.0% |

Commentary:Margins have slimmed like an actor prepping for a biopic — OPM down to 23%. The company’s “steady” is admirable, but not cinematic. While revenues grew YoY, sequential pressure shows US price erosion and R&D drag. EPS annualised is about ₹64.4 — giving a P/E of roughly19.9x, reasonable when your sector trades at 32x.

5. Valuation Discussion – Fair Value Range

Only

Let’s slice the valuation pie three ways:

a) P/E Method:Annualised EPS = ₹16.1 × 4 = ₹64.4Applying a reasonable sector-discounted range of 18×–22× →Fair Value Range = ₹1,160 – ₹1,417

b) EV/EBITDA Method:EV/EBITDA = 11.2 currently.If re-rated to 10×–12× FY26E EBITDA (~₹8,500 Cr):EV = ₹85,000 – ₹1,02,000 CrImplying equity value of roughly ₹1,200 – ₹1,400 per share.

c) Simplified DCF:Assuming 10% revenue CAGR, 18% PAT margin, 10% WACC, 3% terminal growth —DCF fair range emerges at₹1,250 – ₹1,450.

→ Educational Takeaway:All models converge around ₹1,200 – ₹1,450 — comfortably near CMP ₹1,284.

Disclaimer:This fair value range is for educational purposes only and is not investment advice.

6. What’s Cooking – News, Triggers, Drama

This quarter was a full Bollywood release:

- USFDA obsessions:The FDA gifted not one butthreeForm-483s this quarter — Bachupally biologics (5 observations), Mirfield API (7 obs), and Srikakulam (7 obs). The EIR came later marking one “Voluntary Action Indicated” — which in pharma-speak means “You’re naughty, but not grounded.”

- Acquisition binge:The ₹4,464 million STUGERON® portfolio buy from Janssen gives Dr. Reddy’s control over 18 APAC/EMEA markets. Maybe they’ll soon add “dizziness management” as a KPI for investors too.

- Tax and legal:The company is still battling a ₹2,395 crore reassessment notice — but hey, what’s Indian pharma without a side of tax litigation?

- Strategic play:Continuing biosimilar expansion with Alvotech to co-develop a Keytruda biosimilar — a potential blockbuster in 2027.

- HR drama:CHRO Archana Bhaskar resigned, Sanjay Sharma takes charge Dec 1. HR handovers are smoother than FDA audits (so far).

Who needs Netflix when you can just follow Dr. Reddy’s regulatory timeline?

7. Balance Sheet

| (₹ Cr) | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | Mar 2025 |

|---|---|---|---|---|---|

| Total Assets | 26,588 | 29,746 | 32,209 | 38,780 | 48,023 |

| Net Worth (Equity + Reserves) | 17,641 | 19,212 | 23,286 | 28,254 | 33,549 |

| Borrowings | 3,031 | 3,384 | 1,347 | 2,002 | 4,677 |

| Other Liabilities | 5,915 | 7,149 | 7,576 | 8,523 | 9,797 |

| Total Liabilities | 26,588 | 29,746 | 32,209 | 38,780 | 48,023 |

Sarcastic Takeaways:

- Assets growing faster than gym memberships in January.

- Debt jumped 2.3× in FY25 — maybe to fund those biosimilar dreams.

- Reserves up like