🧾 At a Glance

Control Print Ltd, a ₹1,258 Cr company, isn’t flashy like AI or EV stocks, but it’s built like a dividend-paying tank. India’s only domestic manufacturer of industrial coding and marking printers, it posted a jaw-dropping84% profit growthin FY25. Add a fat 27% ROE, zero debt, and a consistent dividend – and this might just be the most boringly beautiful stock you’ve never heard of.

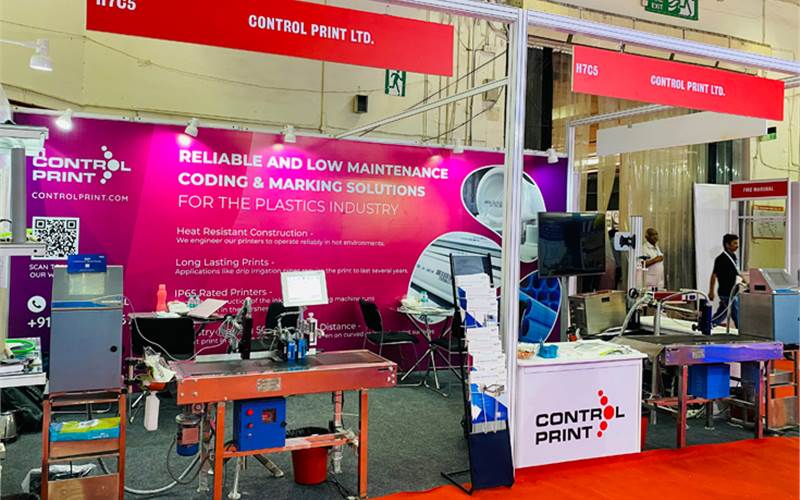

1️⃣ WTF Do They Even Do?

No, Control Print doesn’t design logos.

🖨️ It makesindustrial printers and consumablesused to print expiry dates, QR codes, barcodes on:

- Packaged food

- Pharma bottles

- FMCG labels

- Chemicals and even… Face Masks 😷 (added during COVID, still going)

🎯 Products:

- Coding & marking printers

- Inks, solvents, and spares (recurring revenue, baby)

- Face masks (small biz line, but still kicking)

2️⃣ Financials – Profit, Margins, ROE, Growth

5-Year Snapshot 📊

| Metric | FY20 | FY25 | CAGR |

|---|---|---|---|

| Revenue | ₹195 Cr | ₹425 Cr | 17% |

| Net Profit | ₹26 Cr | ₹100 Cr | 27% |

| EBITDA Margin | 24% | 19% | (compressed recently) |

| ROE | 16% | 26.8% | 📈 |

📦 Installed base: 21,000+ printers📍 Coverage: 2,700 pin codes, 1,700+ towns

This company isn’t growing via blitzkrieg – it’s compounding like a disciplined SIP investor.

3️⃣ Valuation – Cheap, Meh, or Crack?

| Metric | Value |

|---|---|

| CMP | ₹787 |

| P/E | 12.6x |

| Book Value | ₹258 |

| P/B | 3.05x |

| Dividend Yield | 1.27% |

| ROE | 26.8% |

🧠Fair Value Estimate:

Assuming 15–20% EPS growth, FY26E EPS ~₹72–₹75Applying P/E range of 14–18x:👉FV Range = ₹1,000 – ₹1,350

At ₹787, this is still in “value buy” territory. The market hasn’t caught on fully… yet.

4️⃣ What’s Cooking – Triggers, Expansion, Noise

- FY25 PAT jumped 84%: From ₹55 Cr → ₹100 Cr 💥

- Dividend announced: ₹10/share, ~1.3% yield

- Capex-light business: Annual depreciation <₹20 Cr, asset turns improving

- Expansion