1. At a Glance – The Assam Tea Veteran Having a Midlife Crisis (and We’re Watching 🍵)

B & A Ltd is that 110-year-old Assamese tea planter who suddenly woke up one morning, looked at Tata Consumer, looked at its own stock chart, and said: “Bas bhai, ab packaged tea bhi karenge.” With a market capitalisation of roughly ₹121 crore, a stock price hovering around ₹391, and a bruised one-year return of nearly -31%, this is not a momentum darling. But it is trading at 0.74x book value, which already makes value investors rub their chins like old uncles at a wedding buffet.

Latest quarterly numbers? Revenue of ₹103 crore, PAT of ₹26 crore, and an EPS of ₹82 that swings like Assam monsoon weather—sometimes torrential, sometimes bone-dry. ROCE sits near 9%, ROE at a polite but underwhelming 6%, and debt-to-equity at 0.53, meaning the balance sheet is not drowning but also not floating carefree.

This is a company that owns 11 tea estates, sells bulk tea, makes packaging, has just bought its first new tea garden in 60 years, and is now entering branded retail tea. Basically, B & A Ltd is doing everything at once—like a joint family where everyone suddenly wants to start a startup. Curious already? Good. You should be.

2. Introduction – From Colonial Tea Leaves to Modern Confusion

B & A Ltd traces its roots back to 1915, when Barasali Tea Company Ltd was founded, probably when tea auctions were conducted by men with moustaches thicker than balance sheets. Over the decades, the company quietly did what it knew best—grow black tea in Upper Assam, sell it at auctions, and earn respectable but boring returns.

But boring doesn’t survive stock markets forever.

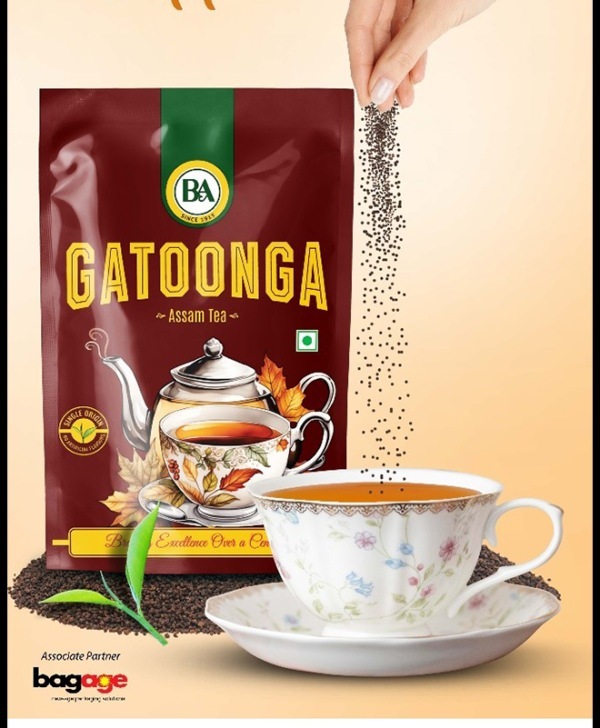

The Indian tea industry has been brutal. Input costs go up, labour issues never end, weather behaves like a crypto chart, and branded FMCG players hog all the margins. B & A survived this chaos by producing premium CTC tea, often fetching higher-than-average auction prices. Some of its estates—Gatoonga, Mokrung, and Salkathoni—have literally topped all-India price rankings. Flex level: serious.

Then came the existential question: “Sirf bulk tea se kab tak?”

So B & A diversified. Packaging came in via subsidiary B & A Packaging India Ltd. Then flexible laminates. Then in January 2024, the company shocked everyone by acquiring Moheema Tea Estate—its first acquisition in six decades. And finally, it launched its own branded retail tea under the “Gatoonga” label in March 2024.

Is this transformation smooth? Absolutely not. Is it interesting? Oh yes. Are investors confused? Completely.

3.

Business Model – WTF Do They Even Do? (Besides Tea, Obviously)

At its core, B & A Ltd is still a tea planter. It owns and operates 11 tea estates across Upper Assam—Jorhat, Sibsagar, Golaghat—places where tea isn’t a beverage, it’s a personality trait.

The company cultivates green leaves, processes them into CTC black tea, and sells primarily through auctions and some private sales. Annual production is around 5.5 million kilograms, sourced from its own gardens and some outsourced leaf purchases. Installed processing capacity is much higher at 34.6 million kg, which tells you two things: there’s room to grow, and there’s idle capacity staring at management every morning.

Then comes packaging. Through its listed subsidiary, B & A Packaging India Ltd, the group manufactures paper sacks and flexible laminates used for tea, chemicals, and carbon black. This is not glamorous, but it’s cash-flow friendly and less dependent on weather tantrums.

The newest experiment? Branded retail tea. With the Gatoonga brand launched in March 2024, B & A wants to move from auction price-taker to shelf-price dictator (at least in theory). This is a margin game, but also a marketing and distribution nightmare.

So the business model today is a three-legged stool: bulk tea, packaging, and branded aspirations. Will it balance? Or wobble? That’s the billion-rupee question.

4. Financials Overview – When EPS Behaves Like a Roller Coaster 🎢

Result Type Detected: Quarterly Results (Locked)

EPS Annualisation Rule Applied: Latest EPS × 4

Quarterly Performance Snapshot (₹ crore, consolidated)

| Metric | Latest Qtr (Sep 2025) | YoY Qtr | Prev Qtr | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 103 | 97 | 56 | 5.7% | 83.9% |

| EBITDA | 30 | 30 | -0 | ~0% | Massive |

| PAT | 26 | 26 | -2 | 0.3% | LOL |

| EPS (₹) | 82.23 | 82.00 | -8.97 | 0.3% | Astrology |

Annualised EPS (for valuation maths only): ₹82.23 × 4 ≈ ₹329

Yes, this EPS is insane. No, it is not stable. Tea