1. At a Glance – “NBFC by Registration, Real Estate by Destiny”

Alfred Herbert (India) Ltd currently sports a market cap of ~₹207 crore while sitting on a book value north of ₹7,300 per share. Yes, you read that right. The stock is trading at ~0.37x book value, a number so low it looks like a typo — but sadly, it isn’t.

The stock price is hovering around ₹2,695, down ~13% over the last three months and ~30% over six months. Meanwhile, reported TTM PAT is ₹452 crore, and EPS is a mind-bending ₹5,863. This makes the P/E ratio ~6.6, which again looks absurd… until you realize almost the entire profit came from exceptional property sales, not from any sustainable business engine.

Operationally, Alfred Herbert is an NBFC on paper, a manufacturing zombie in practice, and a real-estate liquidation vehicle in spirit. The company owns valuable land assets accumulated over a century, and FY25–FY26 has effectively turned into a property monetisation festival.

So the big question:

Is this a deep value opportunity, or just a one-time accounting firework that already went off?

Let’s open the ledger and find out.

2. Introduction – A 100-Year-Old Company Having a Mid-Life Crisis

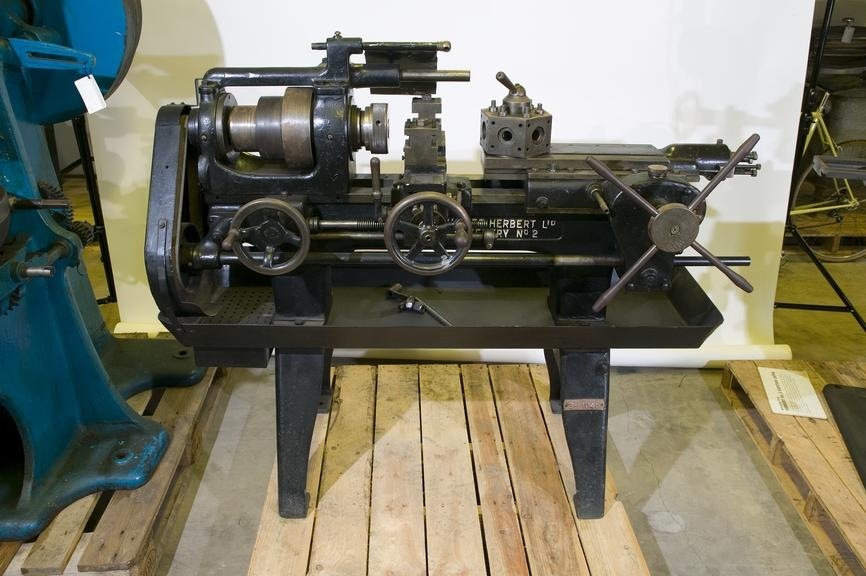

Founded in 1919, Alfred Herbert started life as a serious industrial player, supplying imported machine tools and later manufacturing machinery for rubber and tyre industries. Fast forward a century, and the operating business has quietly taken a backseat while the balance sheet became the real hero.

Today, Alfred Herbert operates through two subsidiaries:

- Herbert Holdings Ltd – NBFC / investment activities

- Alfred Herbert Ltd (AHL) – manufacturing machinery for rubber & tyre industries (technically alive, economically injured)

Over the years, the manufacturing subsidiary has absorbed ₹521.89 lakh of loans and still managed to lose money consistently. Management eventually accepted reality and shut down in-house manufacturing, retaining only spare-parts execution via third-party sourcing.

What remained?

Land. Lots of land.

In Bangalore and Kolkata.

And FY26 finally answered the question:

“What if we just sell the land instead?”

3. Business Model – WTF Do They Even Do?

Let’s be brutally honest.

Segment 1: Manufacturing Operations

- Mostly shut down

- In-house manufacturing discontinued

- Only spare parts execution via third parties

- Zero meaningful revenue driver today

This segment exists more for historical nostalgia than cash generation.

Segment 2: Realty, Investments & NBFC Activities

This is where all the action is.

Revenue mix in FY22 already told the story:

- Sale of products: ~36%

- Other income + fair value gains + dividends: ~50%+

- Interest income: just ~9%

In short, Alfred Herbert does capital allocation, asset monetisation, and accounting gymnastics, not traditional NBFC lending.

If this were a movie genre, it wouldn’t be “Financial Services”.

It would be “Slow-Burn Real Estate Liquidation Thriller”.

4. Financials Overview – When One Quarter Destroys All Comparisons

Quarterly Comparison Table (₹ crore, consolidated)

| Metric | Latest Qtr (Q3 FY26) | YoY Qtr | Prev Qtr (Q2 FY26) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 17.0 | 8.0 | 18.0 | +112% | -6% |

| EBITDA | 16.0 | 7.0 | 16.0 | +129% | 0% |

| PAT | 14.0 | 7.0 | 14.0 | +110% | 0% |

| EPS (₹) | 181.5 | 86.5 | 175.1 | +110% | +4% |

Witty commentary:

These growth rates look impressive until you realize the base is tiny and the profits are asset-sale driven. This is not operational leverage — this is balance-sheet leverage.

EPS Reality Check (Annualisation Rule)

Since this is Q3 (December):

- Annualised EPS = Average of Q1, Q2,