1. Opening Hook

When even your iRobot vacuum cleaner is whining about inflation, Affordable Robotic decides to turn profitable — talk about poetic justice in automation. 🤖

From welding steel in Pune to flirting with FedEx and Target in the U.S., ARAPL’s script this quarter was part Desi hustle, part Silicon Valley pitch. As the Bhagavad Gita says, “You have the right to work, not to the fruits thereof.” But clearly, Milind Padole disagreed — the fruits are sweet this time.

Stick around; the real sparks start when we talk HUMRO and its American invasion.

2. At a Glance

- Revenue up to ₹26 Cr: From ₹19 Cr last quarter — growth finally went bionic.

- EBITDA margin 23%: CFO calls it “efficiency”; investors call it “finally.”

- PAT ₹4.18 Cr: From a ₹3.6 Cr loss — automation finally automated profits.

- Order book ₹140 Cr: Plants packed till March; even Excel sheets are sweating.

- Consolidated PAT ₹0.87 Cr: Small profit, but hey, first step for a humanoid.

- Debt ₹55 Cr: Still human, not yet cyborg-level leverage.

3. Management’s Key Commentary

“We turned profitable this half after six years of losses.”

(Translation: The accountants finally get to smile in the annual photo 😏)

“Our focus is on cost optimization, re-engineering, and different materials.”

(Read: We swapped steel for jugaad and it worked.)

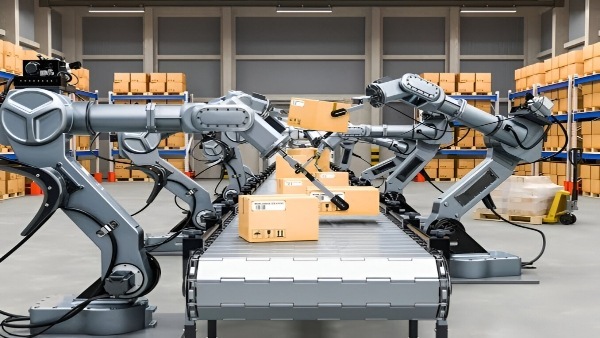

“We shipped 20 robots to the U.S. — FedEx, DHL, GXO are all talking to us.”

(A rare Indian export that doesn’t

need a visa stamp.)

“Promoter infused ₹26 Cr as an interest-free loan; may convert to equity.”

(Also known as: ‘I sold my shares to HNIs, but the money’s still in the family.’)

“HUMRO rebranded — Human + Robot — to symbolize collaboration.”

(Basically, Iron Man with a Marathi accent.)

“We can make 300 robots annually.”

(Only if no one books another Mercedes this quarter.)

“We’ll be a billion-dollar company in 4–5 years.”

(Said every founder before the Series B pitch deck dropped 😉)

4. Numbers Decoded

| Metric | Q2 FY26 | Q1 FY26 | Q2 FY25 | Commentary |

|---|---|---|---|---|

| Revenue (₹ Cr) | 26 | 19 | 22 | Welding + Warehouse units driving growth |

| EBITDA (₹ Cr) | 6.26 | (2.0) | (3.4) | 23% margin – cost cuts finally cut |

| PBT (₹ Cr) | 4.38 | (3.6) | (3.2) | Swinged from loss to profit |

| PAT (₹ Cr) | 4.18 | (3.6) | (3.2) | First black ink since IPO year |

| Order Book (₹ Cr) | 140 | — | 57 | Factories packed till FY26 end |

| Debt (₹ Cr) | 55 | 58 | 60 | Declining, unlike HR morale at competitors |

Margins up, losses reversed, and CFOs now officially believers in Excel miracles.

5. Analyst Questions

Q: “Will the 140 Cr order book finish this year?”

A: “Only if