1. At a Glance – Blink and You’ll Miss the Profits

Advik Capital Ltd is one of those stocks that looks cheap enough to make your inner bargain-hunter whisper “value”, but the financials scream “emotional damage.”

With a market cap of ~₹81.5 Cr and a share price of ₹1.34, this NBFC trades at 0.46× book value, which on paper looks like a Diwali discount. In reality, the company just reported a Q3 FY26 consolidated loss of ~₹21 Cr, wiping out multiple years of polite, low-decibel profits in a single quarter.

Sales for the quarter came in at negative ₹2.83 Cr (yes, negative — accounting bhi shock mein tha), while PAT collapsed -384% YoY. Debt stands tall at ₹148 Cr, interest coverage is negative, and ROE is stuck in single digits.

Meanwhile, promoters hold just 22.5%, public holds the rest like a hot potato, and returns over the last one year are -35%.

This is not a sleepy NBFC. This is a hyperactive balance sheet doing parkour between capital raises, rights issues, litigation, and strategic “evaluations.”

So… misunderstood turnaround or Excel sheet gone rogue? Let’s audit this drama line by line.

2. Introduction – When “Finance Company” Means Everything and Nothing

Incorporated in 1985, Advik Capital Ltd claims to be in financing, inter-corporate investments, and capital market activities. Translation: jo opportunity dikhe, udhar ghus jao.

Officially, it is a Non-Systemically Important, Non-Deposit Taking NBFC, which means RBI won’t lose sleep over it — but shareholders might.

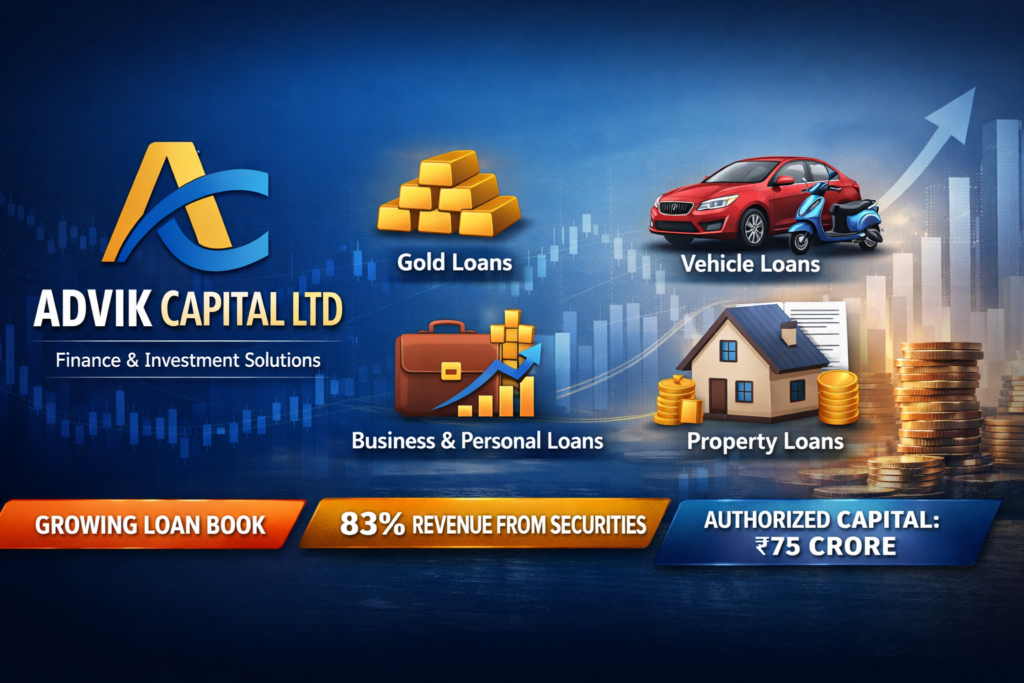

Over the years, Advik has worn many hats:

- Investment company

- Loan financier

- Capital market participant

- Aspiring retail lender (gold, vehicle, personal, property loans — full wedding buffet)

But here’s the plot twist:

As per revenue breakup, ~83% of FY22 revenue came from sale of securities, ~15% from sale of goods, and ~1% from interest income.

Yes, for an NBFC, interest income is basically pocket change.

This already tells you one thing clearly — Advik behaves less like a lender and more like a trading-cum-investment vehicle with a loan license.

Add to this:

- Frequent KMP resignations

- Auditor changes

- Capital base tripling in a few years

- Aggressive borrowing

- Legal disputes and insolvency proceedings

This is not a boring lender. This is a full Bollywood masala script with finance jargon.

3. Business Model – WTF Do They Even Do?

Explaining Advik’s business model to a lazy investor is like explaining crypto to your CA uncle.

What they say they do:

- Gold loans

- Vehicle loans

- Business loans

- Personal loans

- Property loans

Sounds like Bajaj Finance junior, right?

Wrong universe.

What they actually do (based on numbers):

- Deploy capital into securities and inter-corporate investments

- Occasionally sell “goods” (don’t ask which ones)

- Earn negligible interest income

- Fund operations using borrowed money

- Raise equity whenever balance sheet looks tired

Loan disbursements did grow 21% YoY in FY22, but that growth has not translated into stable interest income or predictable cash flows.

This is a financial chameleon — adapting business descriptions faster than profits.

Ask yourself:

If interest income is 1%, is this an NBFC… or a merchant banker without a suit?

4. Financials Overview – Quarterly Numbers That Gave Excel Anxiety

| Metric | Latest Qtr (Dec’25) | YoY Qtr (Dec’24) | Prev Qtr (Sep’25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | -2.83 | 13 | 6 | -122% | -147% |

| EBITDA | -22 | 9 | 4 | NA | NA |

| PAT | -20.9 | 7 | 1 | -384% | -2100% |

| EPS (₹) | -0.34 | 0.12 | 0.01 | -383% | NA |

Consolidated figures in ₹ crore.

This quarter was not a “soft patch.”

This was a financial faceplant.

Negative revenue suggests either reversals, write-offs, or accounting adjustments that deserve a separate Netflix documentary.

EPS for Q3 FY26 is -0.34.

As this is Quarterly Results, EPS annualisation (average ×4 for