⚡ At a glance:

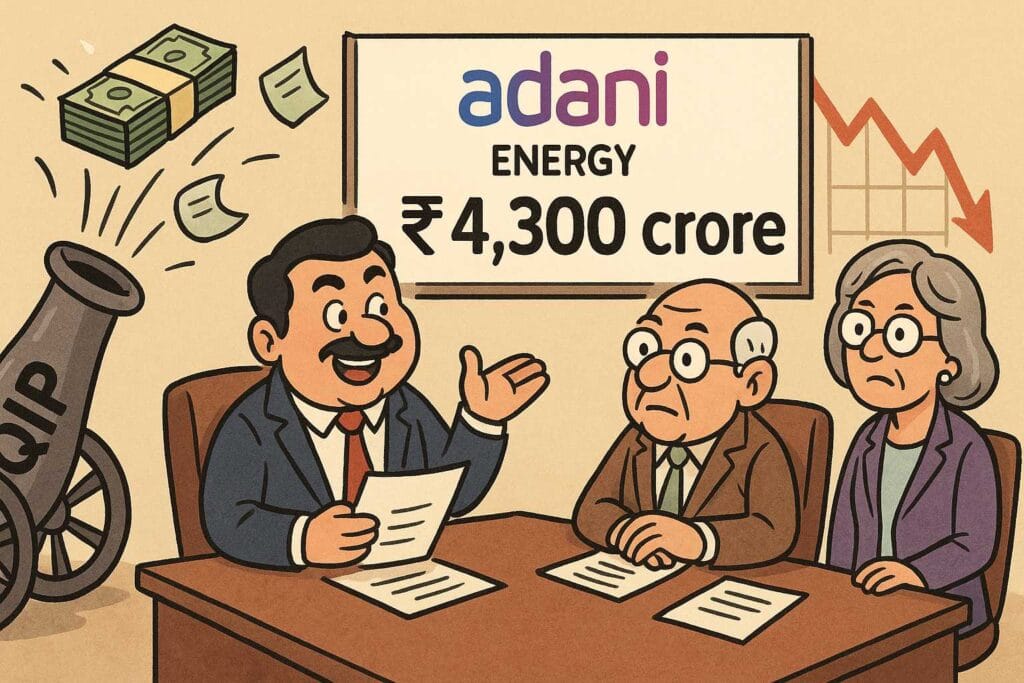

Adani Energy Solutions Ltd just pulled a double whammy:

- 🚀 Announced plans to raise ₹4,300 crore via QIP

- 👥 Appointed 4 new board members — including a civil servant, a Tata Steel veteran, and a regulatory powerhouse

The stock fell 1.49% to ₹867.80 — but the real question is:

Is this fundraise for growth, debt refinance… or a quiet restructuring?

🧾 What Did the Board Approve?

| Agenda | Outcome |

|---|---|

| 💸 Fundraising | QIP/other eligible routes up to ₹4,300 Cr |

| 👨💼 New CEO | Mr. Kandarp Patel becomes Whole Time Director & CEO |

| 👤 New Independent Directors | Mr. Hemant Nerurkar, Dr. Amiya Chandra, Mrs. Chandra Iyengar |

| 🕒 Meeting Duration | 1 hour 15 mins (4:30 PM to 5:45 PM) |

So yes, unlike their 29-hour PSU cousins, the Adani board moves fast.

💰 QIP of ₹4,300 Cr — But Why?

Here’s what could be brewing:

📌 1. Debt Refinance

- AESL has consolidated borrowings upwards of ₹20,000 Cr

- This QIP may be to refinance high-cost debt, especially post-Hindenburg cleanup

📌 2. Infra Capex

- Expansion in smart metering, transmission lines, and green corridor projects

- Adani has been aggressively bidding on interstate transmission projects

📌 3. Balance Sheet Flexibility

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member