1. At a Glance

United Nilgiri Tea Estates Company Ltd is that calm, silent uncle at the family function who doesn’t talk much but owns half the street. Incorporated in 1922, this company has been growing tea before “startup culture” was even a sentence.

At a market cap of ~₹244 Cr and a stock price of ₹489, United Nilgiri trades at a P/E of ~11 and Price-to-Book of ~1.05. That’s not “Instagram influencer valuation,” that’s “balance sheet did the talking” valuation.

Latest quarterly numbers show Q3 FY26 revenue of ₹23.76 Cr and PAT of ₹5.32 Cr, translating into a Q3 EPS of ₹10.65. Annualised? That lands near ₹42–44 EPS, which is exactly where the TTM EPS sits.

Margins remain elite for a plantation business: OPM ~22%, Net Margin ~20%, ROCE ~10%, ROE ~8.7%. No debt. Zero. Nada.

Exports contribute 56% of revenue, organic teas command premium pricing, and the company even throws in rental income and fair value gains just to flex its old-money portfolio.

This is not a “toh kal double hoga” stock. This is a “beta, chai thandi ho jayegi par paisa nahi doobega” business.

2. Introduction

Let’s get one thing straight: tea companies are not supposed to be sexy. They are supposed to be cyclical, weather-dependent, labour-intensive, and forever complaining about wages.

United Nilgiri Tea Estates politely ignored that memo.

While most plantation companies oscillate between losses and prayers, UNTECL has quietly compounded profits, sat on land assets, avoided leverage like it’s bad caffeine, and focused on organic, specialty, export-grade teas.

Sales growth? Meh.

Profit growth? Solid.

Cash flows? Predictable.

Governance?

Boring in the best way.

Over the last decade, sales CAGR ~6–7%, but profit CAGR ~8–12%, with 3-year profit growth touching ~26%. This is classic margin expansion + premium pricing doing its job.

If this company were a person, it wouldn’t be on Twitter. It would be at the club, sipping Darjeeling, judging everyone silently.

3. Business Model – WTF Do They Even Do?

At its core, United Nilgiri does two things:

- Grows and manufactures tea

- Rents out property and invests surplus cash

Tea Business (The Main Act – ~93% Revenue)

The company operates tea estates in the Nilgiris and focuses heavily on:

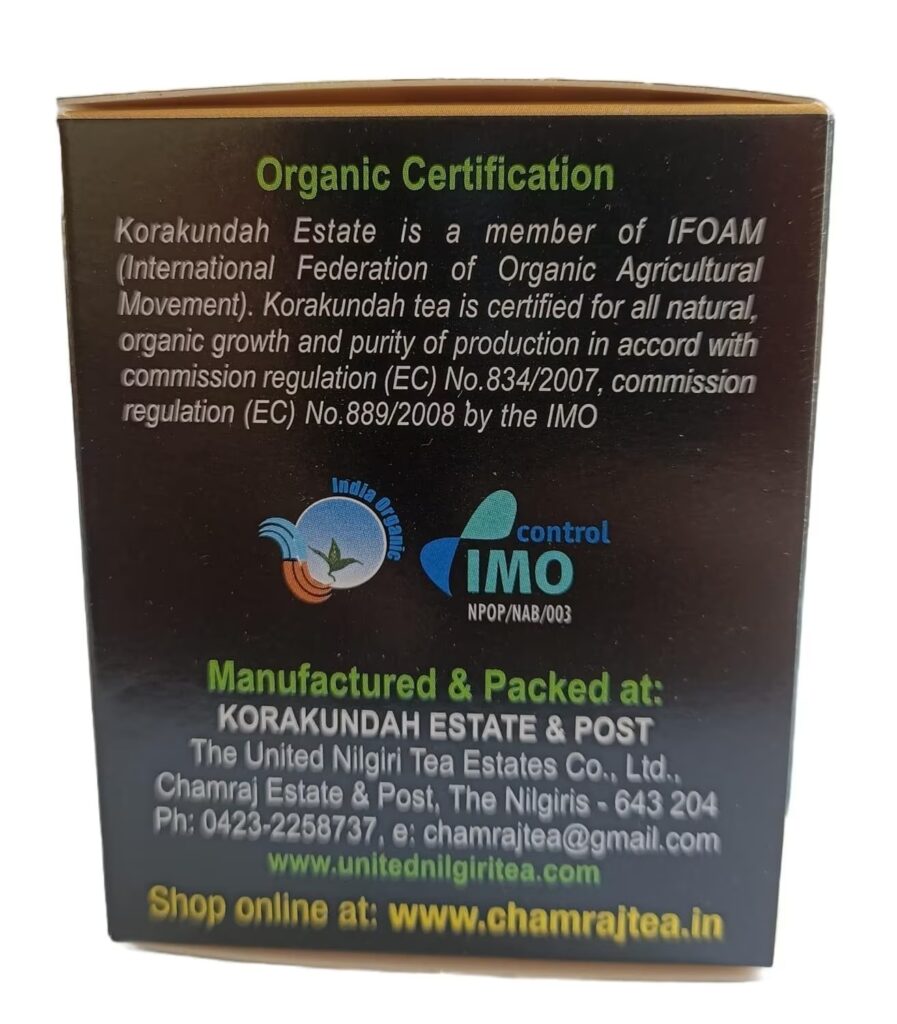

- Organic teas

- Specialty teas

- Export-oriented blends

Brands include:

- Chamraj (black, specialty, gift teas)

- Korakundah Organic (green, herbal, organic variants)

Product categories range from regular teas to high-end specialty and flavoured teas. This isn’t mass-market chai dust; this is “single-estate orthodox” tea sold to people who pronounce terroir correctly.

Property & Other Income (The Side Hustle – ~7%)

Rental income, licence fees, interest income, and fair value gains on investments form a meaningful chunk of profits.

In FY25,