1. At a Glance – The 1935 Vintage That Refuses to Retire

This is not a startup. This is not a turnaround story with TED Talk vibes. This is a 1935-born British-era survivor that still sells tea, spins yarn, builds EPC projects, and collects rent from a heritage building in Kolkata — all under one corporate umbrella like a confused family WhatsApp group.

Market cap sits at ₹194 Cr, current price ₹90.9, and the stock trades at 0.76× book value, which already screams “I’m cheap but please don’t ask why.” Over the last 3 months, the stock is down ~24%, which means anyone who bought recently is already emotionally invested.

Latest quarter (Q3 FY26) delivered ₹106.8 Cr revenue, down YoY, but PAT jumped 65.7% QoQ to ₹4.54 Cr — largely because losses in prior quarters made the base look like Swiss cheese. ROE and ROCE hover around ~6.8%, which is neither sexy nor alarming — just… tired.

Promoters (Kothari Group) hold ~69%, no pledge, debt at ₹147 Cr, interest coverage under 2×. This company is not sprinting. It is limping forward with dignity, hoping markets will someday respect consistency over excitement.

So the real question: Is this a dusty balance sheet bargain, or just a museum piece with quarterly earnings calls? Let’s find out.

2. Introduction – A Corporate Time Capsule with Multiple Personalities

Gillanders Arbuthnot is what happens when a company refuses to choose one career path for 90 years. Tea planter? Yes. Textile spinner? Also yes. EPC contractor? Why not. Real estate landlord? Obviously. Overseas subsidiary in Mauritius? Just vibes.

This is a Kothari Group flagship, and historically, it mattered. Today, it survives. Over the last decade, sales CAGR is negative, profits are erratic, and returns have tested investor patience more than a PSU AGM. Yet — it still exists, still generates cash, and still hasn’t diluted shareholders

into oblivion.

The company’s biggest strength and weakness is the same thing: diversification. When tea bleeds, textiles cough. When EPC misbehaves, rental income quietly pays the chai bill. This is not a growth stock — it’s a portfolio of aging businesses glued together by accounting discipline.

If you’re hunting for momentum, stop reading.

If you like deep value, legacy assets, and “what if things normalize” scenarios — welcome home.

3. Business Model – WTF Do They Even Do?

Let’s simplify this corporate thali.

🧵 Textiles Division

50,000 spindles in West Bengal producing grey, mélange, dyed, fancy yarns across cotton, polyester, acrylic, viscose, modal blends. Sounds impressive until you realize textiles is a margin-starved battlefield where survival itself is a KPI. This division is cyclical, working-capital heavy, and allergic to stable ROCE.

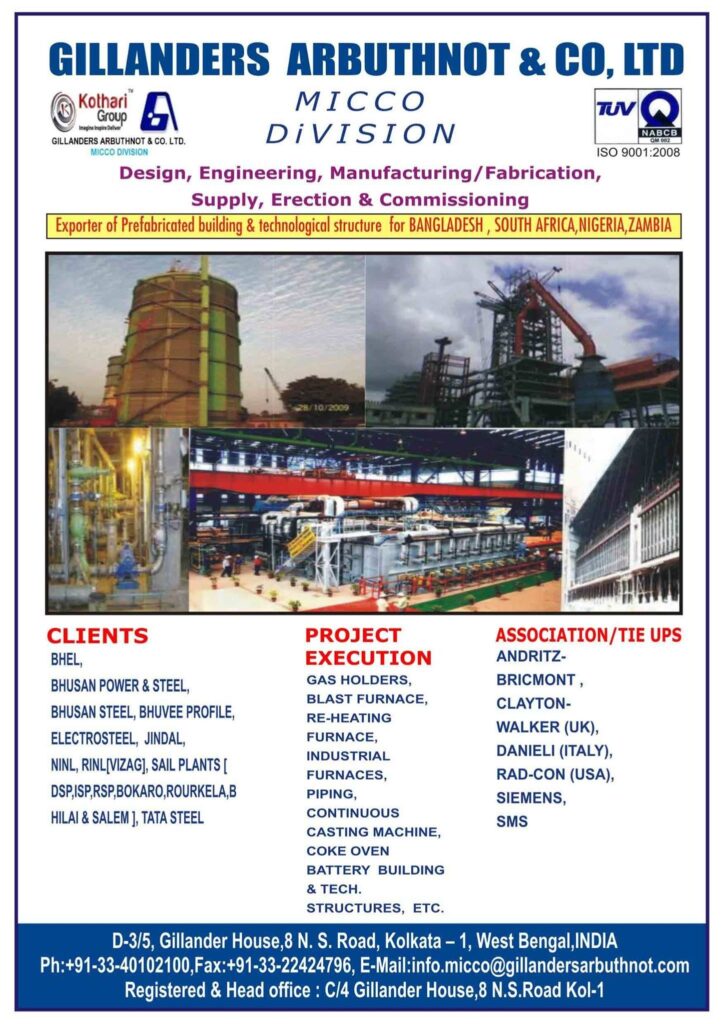

🏗 Engineering Division (MICCO)

This is the EPC arm executing turnkey engineering and construction projects across India. Revenue is lumpy, margins are thin, and execution risk is permanent. One delayed project and profits evaporate faster than optimism in a small-cap Telegram group.

🍃 Tea Division

The most romantic but brutally real business.

8 gardens, 6 factories, ~10 million kg tea annually across Assam & Dooars. Tea prices fluctuate, labor costs rise, weather plays God. But this division contributes ~54% of