1. At a Glance – Blink and You’ll Miss the Debt

₹165 crore market cap. Stock down ~27% YoY. Revenue sprinting like a tractor in low gear but torque is real. Q3 FY26 sales at ₹35.7 crore (+26% YoY) and PAT at ₹1.67 crore (+16.8% YoY) — respectable for an SME machining shop. OPM holding steady near 14–15%, ROE ~13.5%, ROCE ~11.7%.

But wait. Borrowings are ₹78 crore, debt-to-equity 1.56, interest coverage 2.59. This is not a debt-free Diwali company. Promoters still hold 70.8% (no pledge), FIIs tiptoed in at ~1.7%. Valuation? 21.5× P/E, 10.9× EV/EBITDA, 3.28× P/B — not screaming cheap for a balance sheet that lifts heavy housings all day and heavier interest at night.

Question for you already: Is the market paying for growth or ignoring leverage risk?

2. Introduction – Machining Money the Hard Way

Founded in 2018, PECL is not here to sell dreams; it sells precision-machined iron to OEMs. It’s a subsidiary of Pritika Auto Industries and part of the Pritika Group, a known tractor-component name in North India. Translation: this isn’t a garage startup; it’s a bolt-on capacity expansion vehicle.

The business model is simple, brutal, and OEM-dependent. You invest in land, CNCs, fixtures, quality systems, people… then wait for OEM volumes to behave. When volumes behave, operating leverage smiles. When they don’t, the interest meter keeps running.

FY25–FY26 so far shows strong top-line momentum, helped by higher-weight components, new orders (₹50–70 crore visibility over 4–5 years), and capacity ramp-up. But cash flows? Historically patchy. Working capital? Sticky. Inventory days went north of 140 days. This is not a SaaS company; this is metal, oil, and patience.

So the story is clear: execution vs leverage. Now let’s tear it apart.

3. Business Model – WTF Do They Even Do?

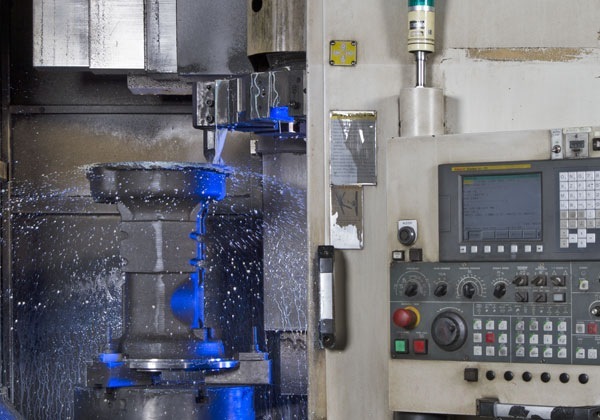

PECL manufactures precision

machined tractor and auto components — think transmission housings, front axle supports, lift housings, axle beam housings, brake housings, differential cases. Heavy, ugly, essential stuff.

- Customers: OEMs (tractors & auto)

- Revenue: ~99% product sales

- Facility: Single plant at Hoshiarpur, Punjab, IATF 16949 certified

- Capacity: ~18,000 MTPA

- Strategy FY24–FY26:

- Move to higher-weight components (better realizations)

- Land acquisition (87,000 sq. ft.) for expansion

- Explore railways & defence components (still early-stage, no numbers yet)

This is a capex-led growth model. No fancy pricing power. Margins depend on mix, scale, and scrap discipline. If OEM volumes cooperate, profits look decent. If not, interest eats breakfast.

Simple question: Can one plant, one geography, and OEM concentration justify premium multiples?

4. Financials Overview – Numbers Don’t Lie, But They Do Smirk

EPS Annualisation

- Q3 FY26 EPS: ₹0.63

- Average of Q1–Q3 FY26 EPS: (₹0.77 + ₹0.85 + ₹0.63) / 3 ≈ ₹0.75

- Annualised EPS: ₹0.75 × 4 ≈ ₹3.0

That broadly matches TTM EPS ₹2.91. No jugaad here.

Performance Table (₹ crore)

| Metric | Latest Qtr (Dec’25) | YoY Qtr (Dec’24) | Prev Qtr (Sep’25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 35.69 | 28.30 | 40.66 | +26.1% | -12.2% |

| EBITDA | 5.21 | 4.52 | 6.00 | +15.3% | -13.2% |

| PAT | 1.67 | 1.43 | 2.25 | +16.8% | -25.8% |

| EPS (₹) | 0.63 | 0.54 | 0.85 | +16.7% | -25.9% |

Commentary:

YoY looks fine. QoQ dipped because Q2 was unusually strong. Not alarming, but volatility exists. This is SME manufacturing — smooth curves