1. At a Glance – The Numbers That Make You Do a Double Take

Deep Industries Ltd is one of those companies where the numbers scream “operator”, but the stock price whispers “meh”. Market cap sitting at ₹2,661 crore, current price hovering around ₹414, while the company casually clocks Q3 FY26 revenue of ₹221.5 crore (+43% YoY) and PAT of ₹71.3 crore (+49.8% YoY). Operating margins? A chunky ~45% in the latest quarter. Order book? A spicy ₹3,050 crore, which is almost 4x FY22 levels.

And yet… the stock is down ~24% over 1 year. Classic Indian markets behaviour: ignore the boring cash machine until it becomes obvious, then chase it at peak valuation.

Deep covers 70%+ of India’s post-exploration oil & gas services. That’s not a typo. That’s near-monopoly vibes in a niche nobody talks about at parties. Debt? Chill at ₹205 crore, with Debt/Equity ~0.11. Promoters holding steady at 63.5%, no pledges, no drama.

So the real question: Is this a hidden compounder wearing a PSU uniform, or just a cyclical oil services play dressed up nicely for Instagram?

2. Introduction – The Company That Lives Where Oil Stories Don’t Trend

Oil & Gas services in India is not a sexy sector. No flashy EV narrative, no SaaS multiples, no influencer tweets. But Deep Industries quietly shows up every morning, clocks in, compresses gas, dries gas, drills wells, fixes old wells, and sends invoices that actually get paid (eventually… looking at you, debtor days).

Founded in 1991, Deep Industries has spent over three decades doing the dirty, technical, high-risk jobs that PSU oil companies don’t want to do themselves. Post-exploration services are boring to explain, but brutal to execute. You mess up here, you don’t lose users—you leak gas. Sometimes literally.

Despite this, Deep has scaled steadily. From ₹322 crore revenue in FY22 to ₹809 crore TTM, with profit growth running faster than sales. Margins remain fat because this is asset-heavy, specialized,

high-entry-barrier work. Not everyone can wake up and decide to deploy a gas compression unit in Assam next month.

Still, the market seems unsure. Is it cyclical? PSU-dependent? One accident away from bad PR? Or is this a rare Indian oilfield services company that actually behaves like a disciplined private operator?

Let’s open the engine.

3. Business Model – WTF Do They Even Do? (Explained for Smart but Lazy Investors)

Think of Deep Industries as India’s oilfield handyman with a PhD.

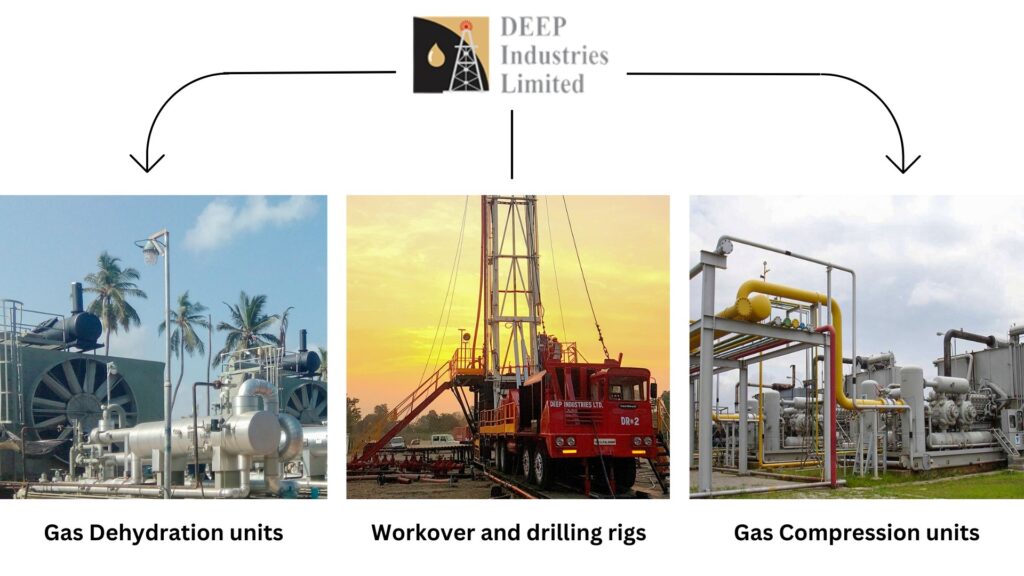

A. Gas Compression Division

Deep is India’s largest natural gas compression service provider on a charter-hire basis. Instead of selling machines, they own, operate, and maintain compression units and rent them long-term to clients like ONGC, GAIL, Oil India, Adani Gas, etc.

This is beautiful because:

- Long-term contracts

- Predictable cash flows

- High switching costs

- PSU babus hate changing vendors

Internationally, through Deep International DMCC, they’ve even picked up compression packages in the USA to serve the Middle East. Desi jugaad meets global hydrocarbons.

B. Gas Dehydration Division

Gas must be dried before it travels through pipelines. Water + gas = corrosion + boom = headlines. Deep provides Build-Own-Operate (BOO) dehydration systems. Again, recurring revenue, minimal client headaches.

C. Drilling & Workover Services

This is where Deep flexes muscle. Drilling new wells and reviving old ones under long-term charter contracts. Approved

1 thought on “Deep Industries Ltd Q3 FY26 – ₹3,050 Cr Order Book, 45% OPM, 70% Market Share: Is This Oilfield Beast Just Misunderstood or Casually Ignored?”

Very crisp and to the point