1. At a Glance – Blink and You’ll Miss the Plot Twist

Parag Milk Foods Ltd is sitting at a market cap of ₹3,022 Cr, trading around ₹242, down a painful ~24% in the last 3 months, while the broader FMCG party keeps playing dandiya. And yet—ironically—Q3 FY26 was the highest-ever quarterly revenue at ₹1,013 Cr, with PAT of ₹30 Cr and 8% volume growth.

So what’s happening here?

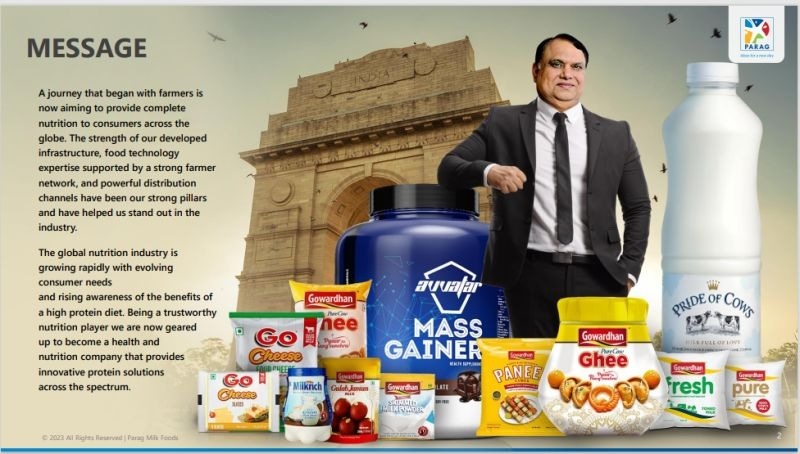

You’ve got a dairy company with 35% cheese market share, 22% cow ghee share, a premium milk brand that literally babysits cows, and a whey protein brand trying to bench-press Amul and global giants. Add to that ₹161 Cr fundraising, debt reduction plans, and BCG hired for “strategic transformation”.

Sounds like a growth story.

Market says: “Hmm, but margins beta, boss.”

Key snapshot:

- Sales (TTM): ₹3,790 Cr

- PAT (TTM): ₹134 Cr

- OPM: 6.84%

- ROCE: 14.1%

- Debt: ₹543 Cr

- P/E: ~22.5x

- Price to Sales: 0.8x (yes, less than 1)

This stock is behaving like a confused topper—marks improving, confidence shaky, valuation stuck in tuition-class trauma. Curious why? Good. Let’s go deeper.

2. Introduction – The Long, Messy Journey from Milk Can to Muscle Powder

Parag Milk Foods isn’t your typical doodh-wala turned listed company. Founded in 1992 by Devendra Shah, this company has spent three decades trying to answer one existential question:

“Should we be a volume milk company… or a branded nutrition business?”

For years, Parag tried doing everything at once—liquid milk, SMP, cheese, ghee, paneer, exports, ingredients, and then suddenly… whey protein. The market punished it for inconsistency, leverage, and margin volatility—especially during FY22 when profits went into a black hole and ROE went negative.

But fast forward to FY24–FY26, something has shifted.

- Revenue is compounding at ~18% over 3 years

- Profits at ~31% CAGR (3Y)

- OPM stabilising near 7–8%

- New-age brands (Avvatar, Pride of Cows) moving from “marketing experiment” to actual revenue contributors

Still, the scars remain. High debt, low single-digit margins, promoter holding drifting down, and a stock chart that gives heartburn.

So the real question isn’t “Is

Parag Milk good?”

It’s: Has Parag Milk finally picked a lane?

Let’s decode.

3. Business Model – WTF Do They Even Do?

Parag Milk Foods runs a multi-layered dairy-plus-nutrition model, which can be broken into four mental buckets:

1️⃣ Core Dairy Staples (Cash Flow Engine)

This includes:

- Gowardhan Ghee

- Butter, curd, paneer

- SMP and dairy ingredients

This is boring, low-margin, but reliable. Think of it as the EMI-paying job.

2️⃣ Cheese – The Actual Crown Jewel

With ~35% market share, Parag is basically the final boss of Indian cheese.

- Largest cheese plant in India

- Raw cheese capacity: 60 MT/day

- Go Cheese World: 40 MT/day

Cheese gives better margins than liquid milk and scales well with QSR, pizza, and food services demand. This is where Parag looks most like a serious FMCG player.

3️⃣ Premium Milk – Pride of Cows

Milk that:

- Comes from owned farms

- Is untouched by human hands

- Delivered farm-to-home

Margins are better, branding is strong, but volumes are limited to urban elites. This is not mass India—it’s Bandra, Pune, Gurgaon India.

4️⃣ New Age Nutrition – Avvatar Whey

This is the wild card.

- India’s first Made-in-India vegetarian whey

- Riding fitness, protein, and influencer culture

- Higher gross margins, brand-led growth

If this works, Parag stops being “just dairy” and starts being a nutrition company. If it doesn’t, it remains an expensive side quest.

Now ask yourself:

Which of these do