1. At a Glance

Meet Narbada Gems & Jewellery Ltd, a 1992-vintage, family-run jewellery house that lives and breathes handcrafted flat-diamond and rose-cut bling. At a market cap of ₹123 crore, the stock trades around ₹58, down ~16.8% over 3 months but still up ~13.7% over 6 months—basically the kind of chart that makes traders frown and long-term folks squint harder.

The latest quarter delivered ₹22.37 crore sales and ₹1.83 crore PAT, translating to ~15% OPM—respectable for a smallcap jeweller juggling gold prices, working capital, and fashion whims. ROCE sits at ~11.4%, ROE ~9.3%, and Debt/Equity ~0.48—not scary, not heroic. Promoters hold a chunky ~75%, zero pledges. Sounds calm? Wait till you meet the 397-day cash conversion cycle. Yes, you read that right. Keep reading.

2. Introduction

Narbada is not Titan. It’s not trying to be Titan. And thank god for that—because Titan already exists and has an 87x P/E. Narbada lives in the narrow, intricate lane of flat diamond and studded gold jewellery, where craftsmanship matters more than celebrity endorsements.

FY23-FY25 was a mixed bag: revenues grew, margins improved, profits popped (TTM profit growth looks explosive), but cash flows stayed… moody. The company is simultaneously expanding capacity, launching heavier designs, and navigating an NCLT-approved amalgamation into Uday Jewellery Industries Ltd. That’s a lot of corporate yoga for a ₹123-crore company.

So the question is simple: is this a quiet compounder polishing itself—or a working-capital monster wearing a shiny necklace?

3. Business Model –

WTF Do They Even Do?

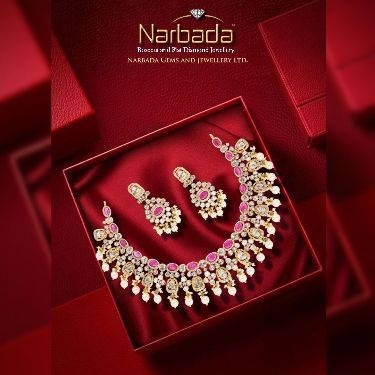

Narbada designs, manufactures, and trades jewellery—primarily studded gold jewellery (~98% of FY23 revenue) with flat diamonds and coloured gemstones. This is not mass-market daily wear. This is royal-necklace, wedding-album, “zoom-in-for-details” jewellery.

Key pillars:

- In-house design team (designers, merchandisers, creative head).

- Handcrafted focus—low automation, high skill.

- B2B-heavy clientele: national chains, regional chains, family jewellers, distributors, exporters.

They sell to everyone from Kalyan & Malabar to niche family jewellers who care more about karigari than Instagram reels. Exports are small (~5%), but management wants more Middle-East love.

Lazy investor summary: They make fancy jewellery for people who already know jewellery.

4. Financials Overview

| Metric | Latest Qtr (Dec-25) | YoY Qtr (Dec-24) | Prev Qtr (Sep-25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue (₹ Cr) | 22.37 | 21.51 | 26.30 | +4.0% | -15.0% |

| EBITDA (₹ Cr) | 3.15 | 2.66 | 4.74 | +18.4% | -33.5% |

| PAT (₹ Cr) | 1.83 | 1.48 | 3.00 | +23.6% | -39.0% |

| EPS (₹) | 0.86 | 0.70 | 1.42 | +23.6% | -39.4% |

Annualised EPS (Q3 rule):

Average of Q1, Q2, Q3 EPS × 4

= (1.10 + 1.42 + 0.86) / 3 × 4 ≈ ₹4.5

At ₹58, that implies a P/E ~13x–14x on annualised earnings—below industry average, above