1. At a Glance – Blink and You’ll Miss the Plot Twist

₹257 crore market cap. Stock at ₹74.7. Down ~51% in one year. Meanwhile, the company quietly posts ₹93.6 crore TTM revenue, 19%+ operating margins, and keeps expanding into logistics, records management, and now mobility services. DJ Mediaprint & Logistics Ltd (DJML) is that quiet overachiever in class who doesn’t sit in the front row but somehow tops the exam.

Q3 FY26 delivered ₹22.5 crore sales with ₹1.71 crore PAT, OPM at 18.9%, and debt-to-equity at a comfy 0.23. Promoters still hold 55.5%, zero pledge, though they trimmed a little last quarter. Add to that a ₹99.5 crore warrant fundraise, a 51% acquisition in Sai Links, and a business that prints, stores, scans, transports, mails, and now moves people too.

So why is the stock sulking? Is the market bored of printing? Or confused by the logistics cosplay? Let’s open the file. Literally.

2. Introduction – From Printer to Postal Ninja

DJML started life in 2009 as a printing company. But staying “just a printer” in India is like opening a DVD rental shop in the age of Netflix. So the company did what survivalists do: diversify aggressively, but logically.

Today, DJML sits at the intersection of printing + logistics + document management + digital outreach. Banks use them for MICR cheques and statements, governments trust them with OMR sheets, corporates dump their old records in DJML’s warehouses, and India Post uses them as an authorised bulk mailer to 97+ countries.

This isn’t a glamorous business. No AI buzzwords. No EV hype (yet). But it’s boring in a very profitable way. High switching costs, compliance-heavy clients, recurring contracts, and steady cash generation—most years, at least.

The market, however, seems confused. Is

this a printer? A logistics company? A services firm? The answer is “yes”. And that confusion shows up in valuation multiples, peer comparisons, and investor attention.

3. Business Model – WTF Do They Even Do?

Explain DJML to a lazy investor like this:

“They print your documents, store your documents, scan your documents, courier your documents, advertise your documents, and now… maybe drive you to work.”

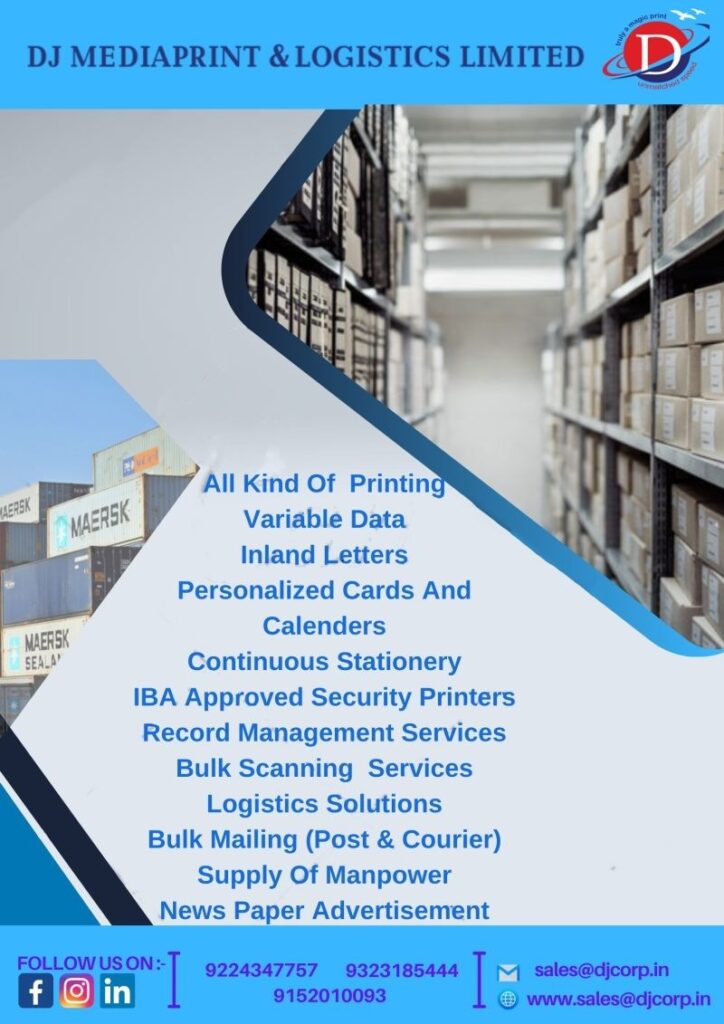

Core Verticals:

- Printing & Security Printing (66.7% of Q1 FY26 revenue)

Commercial printing, variable data printing, MICR cheques, ID cards, OMR sheets. IBA-approved. Boring? Yes. Replaceable? No. - Services (33.3%)

Logistics, document management, bulk mailing, scanning, digital campaigns, manpower supply, newspaper advertising. - Logistics Backbone

Own fleet (15 vehicles), pan-India reach, India Post authorisation, international mailing to 97+ countries. - Records Management

Over 4,00,000 sq ft of secure storage. Once records enter, they rarely leave. Recurring revenue heaven. - New Bet: Mobility Services

Via Sai Links acquisition (51%). Turnover ₹22.4 crore in FY24. Think corporate mobility, staff transport, and managed services.

This is not a “high-growth startup” model. It’s a Swiss Army knife for boring but essential corporate operations.

4. Financials Overview – The Numbers Speak (Softly but Clearly)

Q3 FY26 Performance Table (₹ Cr)

| Metric | Latest Qtr (Dec-25) | YoY Qtr (Dec-24) | Prev Qtr (Sep-25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 22.50 | 20.42 | 25.93 | 10.2% | -13.2% |

| EBITDA | 4.25 | 4.35 | 4.34 | -2.3% | -2.1% |

| PAT | 1.71 | 1.81 | 1.77 | -5.5% | -3.4% |

| EPS (₹) | 0.50 | 0.56 | 0.54 | -10.7% | -7.4% |