1. At a Glance – Blink and You’ll Miss the Punch

Once upon a time, iStreet Network Ltd was a near-dead microcap ghost floating in the GSM graveyard. Fast forward to Q3 FY26, and suddenly this ex-Stage-4-GSM survivor is sitting on a ₹324 Cr market cap, a stock price of ₹48.7, and a 1-year return of 1,044%. Sounds like a Bollywood comeback trailer, right?

But here’s the plot twist: Book value is ₹0.25, Price-to-Book is ~199x, P/E is ~65.8x, and ROCE shows a comical 150%—largely because capital employed was basically on life support. Revenues were zero for years, then boom—₹24.66 Cr in Q3 FY26 sales. PAT jumped to ₹1.20 Cr, with YoY profit growth showing a meme-worthy 4,100% (math does that when your base is near zero).

Debt? Zero. Net worth? Still negative historically but crawling back from the abyss. This stock is not walking—it’s sprinting, tripping, and occasionally doing parkour. Curious already? Good. Let’s go deeper.

2. Introduction – The GSM PTSD Edition

iStreet Network isn’t your regular “missed earnings by 2%” kind of story. This is a corporate rehabilitation case study. After getting slapped into Stage-4 GSM by BSE, trading restrictions choked liquidity, fundraising died, and operations were suspended from April 2017. Capital markets basically told them: “Beta, pehle sudhar jao.”

Years passed with no real business, just survival income—FD interest and dividends. Losses piled up, net worth got fully eroded, and the company became that forgotten penny stock uncle at the wedding—present, but nobody talks to him.

Then came FY25–FY26:

- Operations restarted

- Preferential issues approved

- Warrants issued

- Equity consolidated

- New management faces

- And suddenly…

- revenues!

Is this a turnaround, a trading circus, or a cleverly timed capital-market resurrection? Keep reading.

3. Business Model – WTF Do They Even Do?

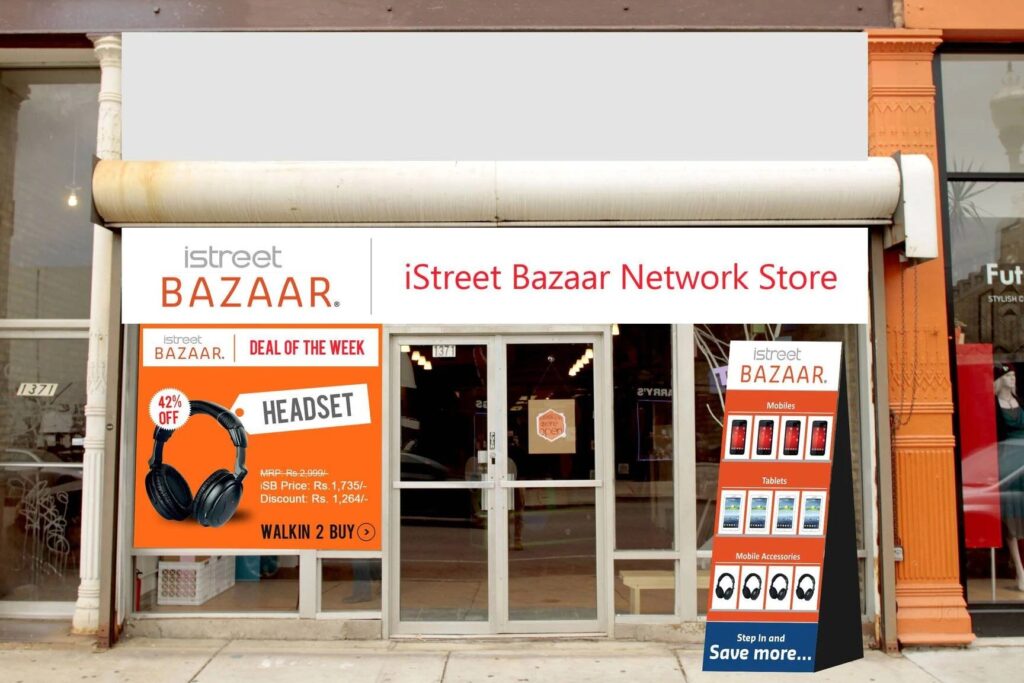

Officially, iStreet Network is an Internet & Retail Catalogue company operating under iStreet Bazaar. In practice, it’s more of a “multi-avatar corporate shapeshifter.”

What they say they do:

- Buy & sell products domestically and internationally

- Act as commission agent / broker

- Provide after-sales service

- Offer marketing & technical consultancy

What they tried earlier:

- Hybrid online + retail catalogue model

- B2B marketplace

- Green mobility / bike-sharing

(All paused due to lack of capital, GST chaos, credit issues, and COVID.)

What they’re talking about now:

- AI projects: computer vision, ML, NLP, analytics

- AI education initiative (FY23) with a tech partner

Right now, the business looks like a restart shell—testing revenue flows while capital structure is being rebuilt. Think of it as a startup wearing a 1988 incorporation certificate.

Lazy investor question: Is this an operating company or a listed SPV for future ideas?

Exactly.

4. Financials Overview – Numbers That Woke Up Suddenly

📊 Quarterly Performance (Standalone, ₹ Crore)

| Metric | Latest Qtr (Dec-25) | YoY Qtr | Prev Qtr | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 24.66 | 0.00 | 18.65 | NA | 32.2% |

| EBITDA | 1.43 | -0.03 | 0.90 | NA | 58.9% |

| PAT | 1.20 | -0.03 | 0.90 | NA | 33.3% |

| EPS (₹) | 0.18 | -0.01 | 0.42 | NA | -57% |