1. At a Glance – Blink and You’ll Miss the Scale

Cholamandalam Investment & Finance Company Ltd (popularly called Chola Finance, because India loves nicknames more than RBI circulars) is currently sitting at a market cap of ₹1.37 lakh crore, trading around ₹1,632, with a P/B of 5.31x and P/E of ~28x. In the last 3 months, the stock sulked (-3.8%), but over 1 year it’s up ~27%, reminding investors that quality NBFCs don’t panic, they just consolidate and then charge interest.

Latest Q3 FY26 numbers?

- Revenue: ₹7,898 Cr

- PAT: ₹1,290 Cr (+18.5% YoY)

- EPS: ₹15.29 (quarterly)

- ROE: ~19.7%

- GNPA: 3.78% (down from scary FY22 levels)

This is not a fintech story, not a hype story, not a PowerPoint-only growth story. This is a branch-heavy, collection-driven, rural-credit juggernaut quietly compounding money while Twitter fights over neobanks.

2. Introduction – Old Money, New Tricks

Chola Finance is part of the Murugappa Group, founded in 1900—which means this group survived British Raj, Licence Raj, Harshad Mehta, IL&FS, COVID, fintech bros, and still has cash left. That pedigree matters in lending.

Unlike shiny app-only lenders, Chola’s DNA is boots-on-ground lending: CV drivers, tractor owners, small traders, rural borrowers, self-employed India. Over time, it has methodically diversified away from pure vehicle finance into LAP, home loans, SME loans, personal loans, supply chain finance, and even mobile phone financing via Samsung.

Between FY22 and Q2 FY25:

- AUM doubled from ₹76,907 Cr to ₹1,64,642 Cr

- Customer base

- exploded from 18.7 lakh to 42.9 lakh

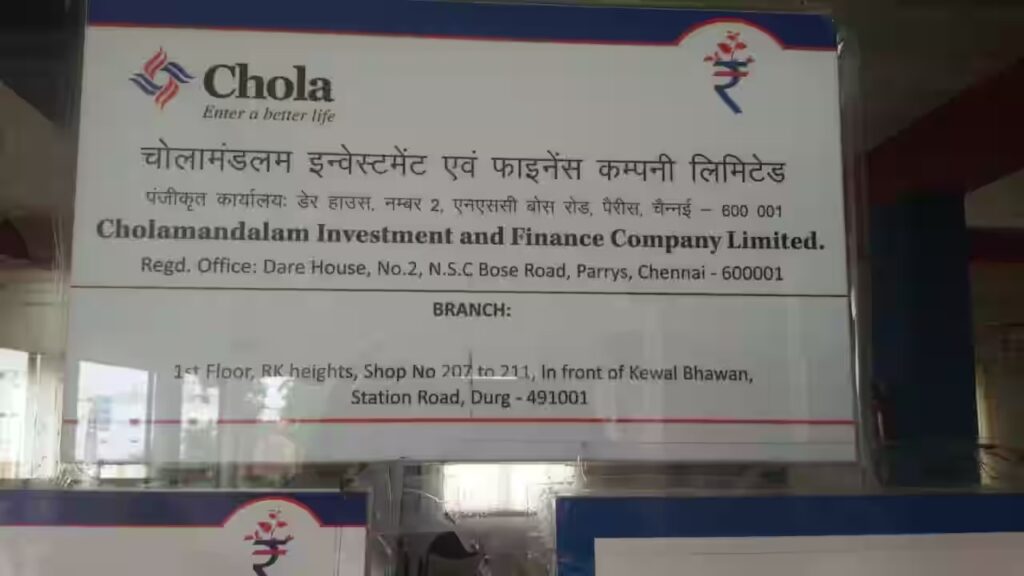

- Branch network expanded to 1,508 locations

Question: How many NBFCs can grow this fast and reduce NPAs? Exactly.

3. Business Model – WTF Do They Even Do?

Think of Chola as a credit supermarket for Bharat.

- Vehicle Finance: CVs, tractors, construction equipment, used vehicles. High yield, high touch, rural-focused.

- Loan Against Property (LAP): SME owners pledging homes for business expansion. Sticky and secured.

- Affordable Home Loans: Middle & lower-middle-income families in semi-urban/rural India.

- Other Businesses:

- SME term loans

- Supply chain finance

- Secured business & personal loans

- Fintech partnerships

- Chola One App

- Samsung mobile financing

The genius? Cross-selling. A tractor borrower today becomes an LAP customer tomorrow and an SME borrower next year. Cost of acquisition drops, lifetime value spikes.

4. Financials Overview – Follow the Money

| Metric | Latest Qtr (Q3 FY26) | YoY Qtr | Prev Qtr | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue (₹ Cr) | 7,898 | 6,733 | 7,491 | 17.3% | 5.4% |

| Financing Profit (₹ Cr) | 1,698 | 1,420 | 1,514 | 19.6% | 12.1% |

| PAT (₹ Cr) | 1,290 | 1,088 | 1,160 | 18.5% | 11.2% |

| EPS (₹) | 15.29 | 12.94 | 13.78 | 18.2% | 11.0% |

Annualised EPS (Q3 rule):

Average of Q1–Q3 EPS × 4 ≈ ₹57–58, matching reported TTM EPS.