1. At a Glance – Blink and You’ll Miss the Plot

Pine Labs is that fintech kid who partied too hard for years, burned cash like Diwali fireworks, then suddenly showed up to office one morning saying, “Guys, I think I figured out profitability.”

Market cap sits at ₹26,611 Cr, stock price chilling around ₹232, down from the IPO sugar rush high of ₹284, and the company has just reported Q3 FY26 revenue of ₹744 Cr, up 23.7% YoY, while PAT jumped 311% QoQ to ₹42 Cr. Yes, you read that right — three-digit growth, from a base that was crying earlier.

But before you shout “Fintech turnaround!” on Twitter, remember this is a company with:

- ROE: -3.31%

- ROCE: -0.49%

- EV/EBITDA: 79x

- Debt: ~₹858 Cr

This is not a boring bank. This is a high-beta fintech thriller. And thrillers come with jump scares.

So the big question:

Is Pine Labs finally becoming a boring, cash-generating fintech… or just having a good quarter after an IPO detox?

Let’s dig. 🍿

2. Introduction – From POS Machines to IPO Machines

Pine Labs was incorporated in 1998, which means it was doing fintech before fintech was cool, before UPI was born, and before VC Twitter started using the word “flywheel” every 3 minutes.

Originally, Pine Labs was a POS hardware + software company. Over time, it mutated into a merchant commerce platform, then into a payments + issuing + BNPL + loyalty + fintech infrastructure monster.

By FY25, Pine Labs was processing:

- ₹11.43 lakh crore GTV

- 568 crore transactions

- Serving ~9.9 lakh merchants

- Working with 177 financial institutions

That’s not a startup. That’s a small digital economy.

Yet despite all this scale, Pine Labs spent most of its life losing money, thanks to:

- Heavy tech investments

- International expansion

- BNPL experiments

- Issuing & prepaid infra costs

- And classic fintech disease: “Growth first, profitability someday”

IPO in Nov 2025 brought in ₹3,890 Cr, some

debt got repaid, balance sheet got Botox, and suddenly — boom — Q1 FY26 profit, Q3 FY26 stronger profit.

Coincidence? Or structural change?

Let’s see what they actually do.

3. Business Model – WTF Do They Even Do?

Explaining Pine Labs to a lazy investor is easy:

“They sit between merchants, banks, consumers, and regulators… and charge everyone a little.”

Now let’s roast it properly.

A. Digital Infrastructure & Transaction Platform (70.5% Revenue)

This is the cash engine.

Includes:

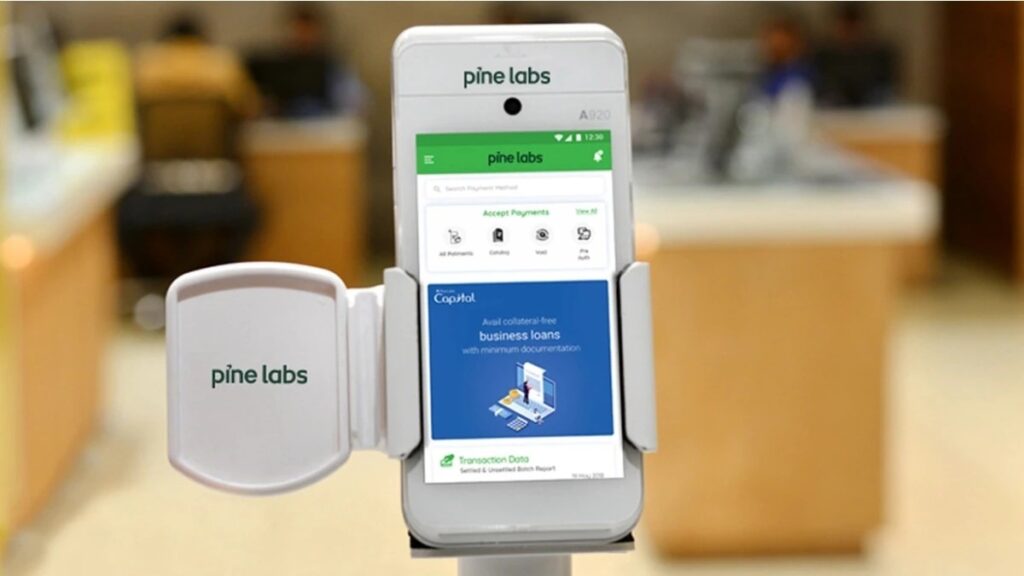

- Smart POS devices

- UPI soundboxes

- Payment gateways (Plural)

- EMI & BNPL at checkout

- Dynamic Currency Conversion

- Analytics & merchant tools

Every time you swipe a card, scan UPI, convert USD to INR, or take EMI on a fridge — Pine Labs takes a cut.

Think of it as toll booth for commerce.

B. Issuing & Acquiring Platform (29.5% Revenue)

This is where Pine Labs becomes a fintech plumber.

Includes:

- Prepaid card issuance

- Closed-loop wallets

- Gift cards

- Loyalty & engagement programs

- Bank-grade processing infra

They’ve issued 367+ crore prepaid cards cumulatively. That’s more cards than most people have shampoo bottles at home.

This segment is sticky, enterprise-heavy, and margin-friendly — but slow burn.

So overall:

- High volume

- Moderate margins

- Heavy infra costs

- Massive operating leverage if profitability sticks

Question for you:

👉 Would you rather own a fintech toll booth