🟢 At a Glance:

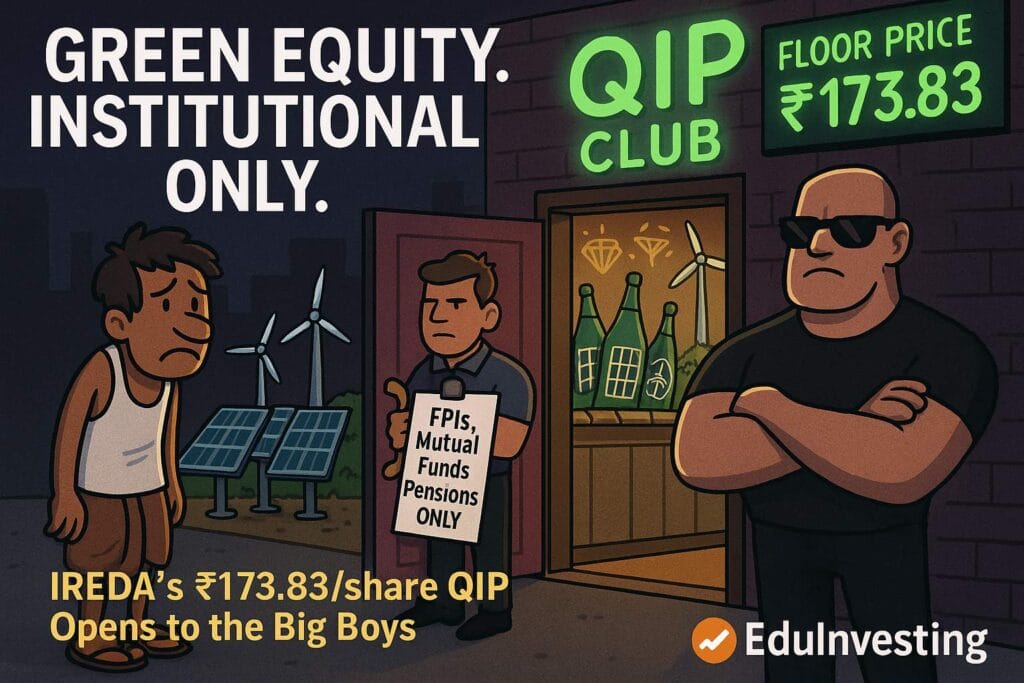

India’s renewable finance engine,IREDA, is raising fresh capital — and it’s doing it the cool institutional way.On June 5, 2025, the company kicked off itsQualified Institutional Placement (QIP)with afloor price of ₹173.83/share, targeting big investors, not retail.

Why does this matter? Because this isn’t just a cash grab — it’s a signal that India’sgreen finance ambitionsare no longer just about bonds. They’re equity-backed, government-blessed, and ready for prime time.

🏦 QIP Details

- 🗓️Issue Opened:June 5, 2025

- 💵Floor Price:₹173.83/share (as per SEBI’s pricing formula)

- 📉Possible Discount:Up to 5% allowed = min issue price ~₹165.14

- 👨⚖️Legal Framework:

- SEBI ICDR Regs, 2018

- Companies Act, Sections 42 and 62

- 📘Preliminary Placement Document:Filed and live onireda.in

Final issue price will be determined with Book Running Lead Managers (BRLMs), because retail can wait — this party’s invite-only.

🧠 Why Is IREDA Raising Funds?

- Expand lending capacityto renewable energy players

- Supportsolar, wind, green hydrogen, and hybrid infra projects

- Meet capital adequacy norms forfuture growth and leverage headroom

- Clean up anybalance sheet risk exposure

In plain terms:money raised here gets lent

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member