1. At a Glance

Radico Khaitan walked into Q3 FY26 like a seasoned bar veteran who knows the bartender by name — confident, loud, and slightly overpriced. The stock trades at ₹2,996, packing a market cap of ₹40,081 Cr, after a -7.24% return over 3 months but a swaggering 35.1% over 1 year. On paper, Q3 sales grew 19.5% YoY to ₹1,547 Cr, while PAT exploded 69.1% YoY to ₹155 Cr. Margins improved too, with OPM at 17%, up from 14% last year.

But here’s the spicy part: Stock P/E sits at ~75.6×, more than double the industry PE of ~33.6×. ROCE at 16.2% and ROE at 13.6% are respectable, but not luxury-champagne-pricing respectable. Debt stands at ₹624 Cr, debt-to-equity 0.21, and interest coverage 11.1×, so lenders aren’t losing sleep.

Premiumisation is the buzzword on every concall, and Radico is shouting it from the rooftop bar. But at this valuation, the market isn’t just buying whisky — it’s buying the story, the bottle, the bartender, and the bar stool. Curious whether the buzz justifies the bill?

2. Introduction

Radico Khaitan is that uncle at a wedding who started life humbly, made steady money, and now insists on ordering single malt for the entire table — while quietly checking who’s paying. Founded in 1943, originally called Rampur Distillery Company, Radico spent decades as a background supplier for others and for CSD. Then in 1997, it said, “Enough being the DJ, I want to be the singer,” and launched 8 PM whisky, which promptly became a millionaire brand within a year.

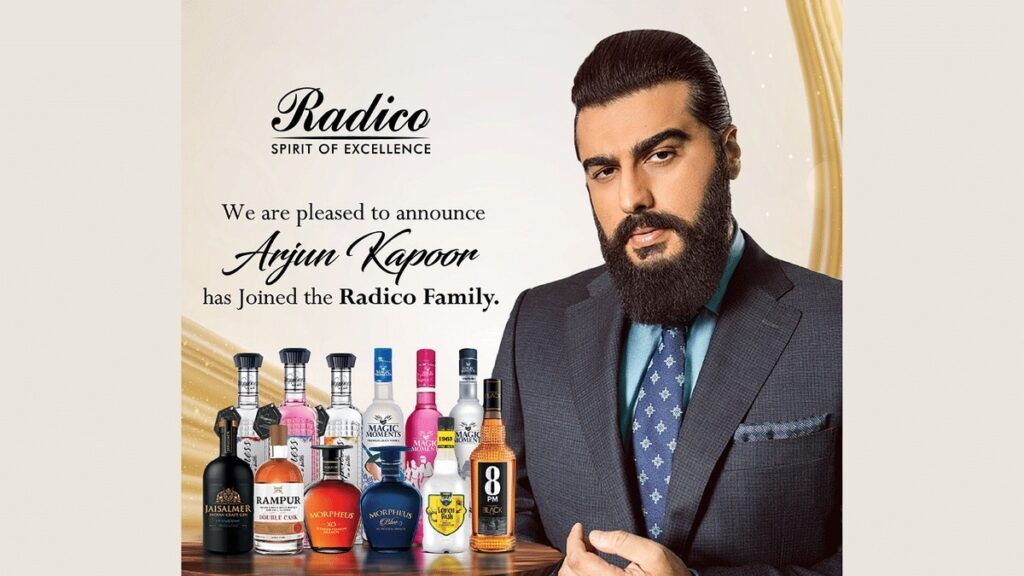

Fast forward to today, Radico isn’t just selling alcohol; it’s selling aspiration. From mass brands to Rampur Indian Single Malt, Jaisalmer Gin, Magic Moments Vodka, and Morpheus Brandy, the company wants to move you from “Friday night drink” to “Instagram-worthy glassware.”

Financially, the last three years have been kind. Sales jumped from ₹3,133 Cr in FY23 to ₹4,843 Cr in FY25, and TTM sales now stand at ₹5,851 Cr. PAT growth, however, has been more moody historically — 5-year profit CAGR just ~7%, before suddenly flexing a 70% TTM jump.

So the question isn’t whether Radico can grow — it clearly can. The real question is: is this growth smooth like aged whisky, or

is it a sharp tequila shot masked by good lighting?

3. Business Model – WTF Do They Even Do?

Radico’s business model is simple: distil, brand, distribute, repeat — and then charge extra if the label looks fancy.

The company operates across three broad buckets:

- IMFL (Indian Made Foreign Liquor) — the core engine, spanning regular, prestige, and luxury brands.

- Non-IMFL — including country liquor and other allied alcohol categories.

- Exports — a smaller but growing showcase segment.

In 9M FY25, revenue mix looked like this:

- Prestige & Above: 49% (up from 42% in FY22)

- Regular & Others: 19% (down from 38% in FY22)

- Non-IMFL: 32% (up from 20% in FY22)

Translation? Radico is deliberately dumping the cheap stuff and flirting hard with premium shelves. Volumes are no longer the hero; realisation per case rose to ₹1,597 in 9M FY25 from ₹1,430 in FY24. That’s pricing power — or at least pricing ambition.

Operationally, Radico runs 4 distilleries in UP, a JV in Maharashtra, and 43 bottling units across India. Capacity stands at 321 million litres annually, which is more than enough to keep party season alive. Distribution spans 1+ lakh retail outlets and 10,000+ on-premise locations, so if you can’t find a Radico product near you, you’re probably in a monastery.

Lazy investor question: when volumes dipped from 28.7 Mn cases in FY24 to 22.21 Mn cases in 9M FY25, did you worry — or did you smile because margins improved?

4. Financials Overview

Result Type Lock: Quarterly Results (Q3 FY26)