🧠 At a Glance

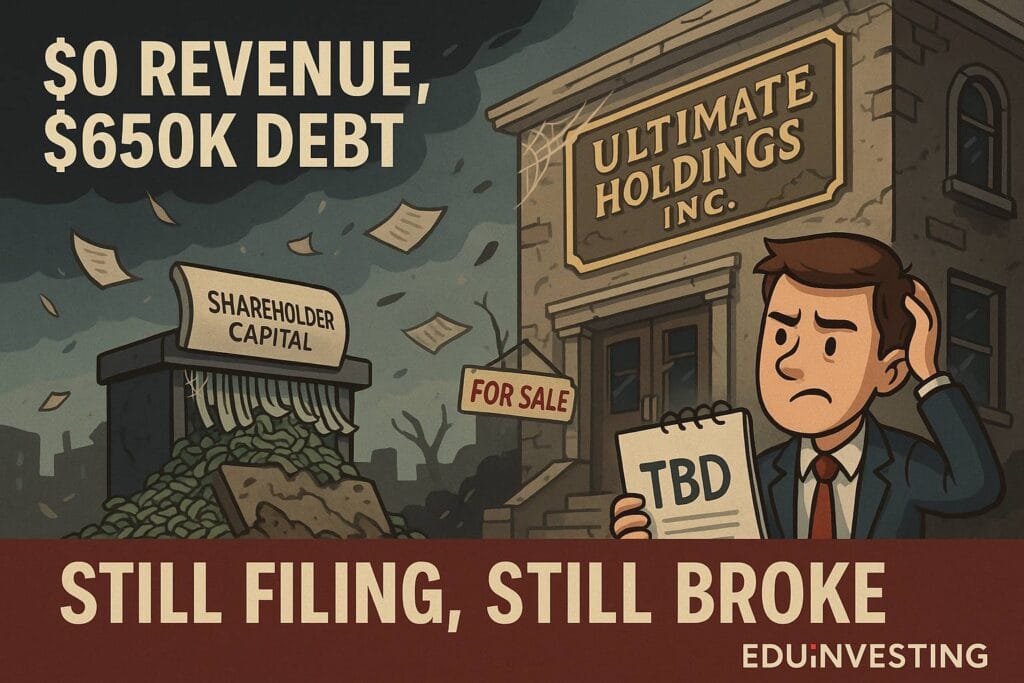

Ultimate Holdings Corp. sounds like the name of a Bond villain’s private equity firm. In reality? It’s more like a barely breathing bulletin board shell.

- 💸 Revenue: $0

- 📉 Net Loss: $178,269

- 🧾 Cash: $6,374

- 💀 Operating Plan: “Identify acquisitions”

- 🪄 Business Model: Promise, pivot, pray

Yes, it’s another company with no operations, no sales, and no shame.

🏢 About Ultimate Holdings Corp.

- Sector: “Technology and data-driven investments”

- Status: Development-stage company (for years)

- Headquarters: Probably a P.O. Box

- Ticker: UHLN (OTC)

Let’s be honest — “Ultimate Holdings” is the kind of name you pick when all real ideas are taken. Their business description is

a LinkedIn bio that ran out of characters.

💰 The Financials (a.k.a. What Financials?)

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Revenue | $0 | $0 |

| Net Loss | ($112,680) | ($178,269) |

| Total Assets | $58,749 | $10,897 |

| Total Liabilities | $569,208 | $650,987 |

| Cash on Hand | $14,590 | $6,374 |

You know things are bad when:

- Losses are growing, but

- Cash is shrinking, and

- Your entire net worth wouldn’t buy a secondhand iPhone bulk pack.

🧾 What They Say They’re Doing

“We plan to identify and acquire potential business opportunities that align with our long-term growth strategy.”

Translation:

“We plan to figure out what we’re doing… eventually.”

This isn’t a company. It’s

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member