1. At a Glance

Kokuyo Camlin Ltd — the iconic brand behind every Indian student’s first ink-stained finger — just dropped its Q2FY26 results, and let’s just say the company’s journey from pencil boxes to PwC audit reports has been one hell of a rollercoaster.

At a market cap of ₹956 crore, trading at ₹95.7, the company is that nostalgic friend who still smells like glue and poster colors — except this one’s being valued at a P/E of 52.7. The book value sits at ₹32.1, and there’s zero dividend yield (because why share the spoils when the ink barely dries?).

Q2FY26 revenues stood at ₹174 crore, with a PAT of ₹7.86 crore — a 174% YoY jump in profit on almost flat sales. ROCE at 3.65% and ROE at 1.95% remind us this is less of a money-printing factory and more of a color palette of cautious optimism. After last year’s ₹21 crore inventory fraud, Kokuyo Camlin has wiped the slate clean (pun intended) and hopes to color in the profit margins next quarter.

But can the Camel still run after being painted into a corner? Let’s dip the brush into the data.

2. Introduction

If you grew up in India, there’s a good chance Kokuyo Camlin has left its mark — literally, on your school shirt. This is the company that made art affordable before “creative economy” was even a thing.

Founded in 1946, back when “Made in India” meant made with genuine sweat and minimal margin, KCL became synonymous with the words “Camel” and “Camlin.” From geometry boxes that every student lost a compass from, to the poster colors that painted half the Diwali cards in the country — this company has been everywhere.

Fast forward to FY25–26, and KCL is trying to sketch a comeback. After being hit by an inventory misstatement scandal at its Tarapur plant — discovered by PricewaterhouseCoopers — the company took a ₹22.7 crore hit and cleaned its books faster than a kid trying to erase exam doodles before the teacher catches him.

Now, with PwC-approved reforms, a Japanese parent (Kokuyo Co. Ltd. of Japan) holding a 74.99% stake, and new management hires straight from the land of precision and minimalism, KCL wants to prove it’s still the Picasso of the pencil world.

The big question — can nostalgia and corporate governance coexist in the same notebook?

3. Business Model – WTF Do They Even Do?

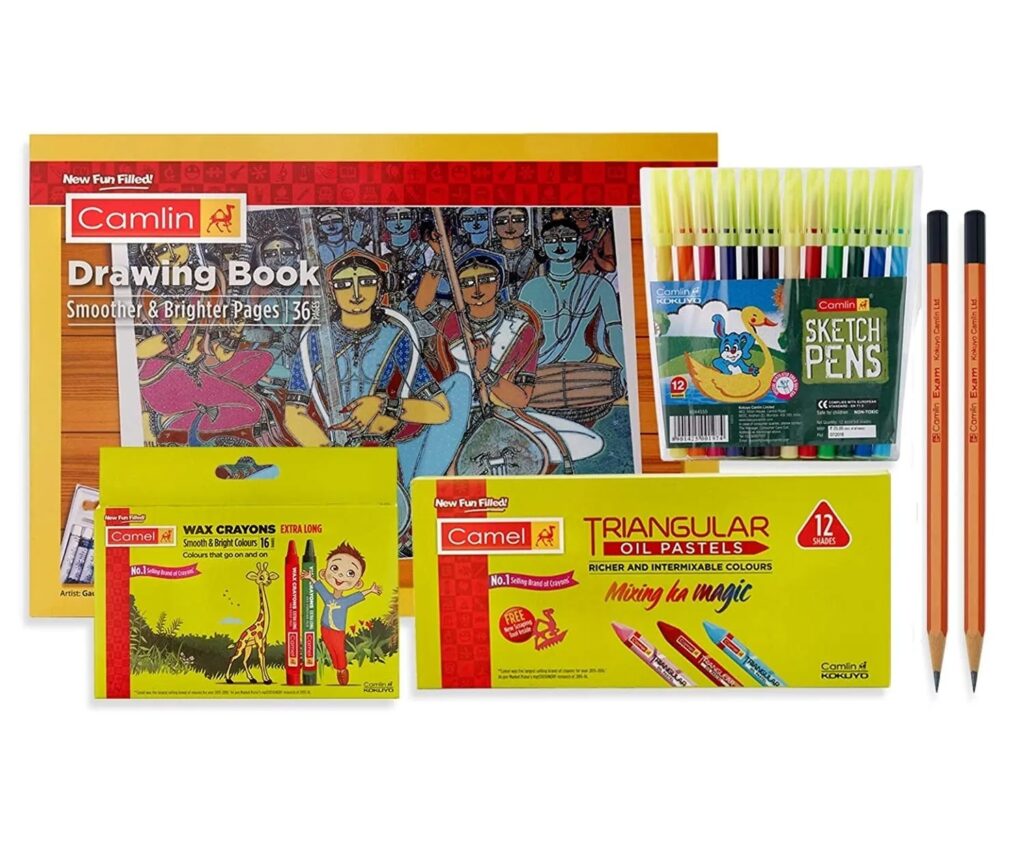

Kokuyo Camlin’s business is beautifully messy — much like a child’s first art project. The company designs, manufactures, and sells stationery, art, and hobby products across categories:

- Camel: the fancy side of the business — paints, brushes, hobby kits, and those oil pastels that made every 90s kid an “artist.”

- Camlin: the practical side — pencils, pens, geometry boxes, adhesives, and office supplies.

KCL operates manufacturing plants in Tarapur, Patalganga, and Samba, producing over 1,500 SKUs — that’s more variety than the average art teacher’s temper.

Its distribution network of over 3 lakh retailers ensures

that whether you’re in Mumbai or Manmad, you’ll find a Camlin product near the school gate.

Revenue mix (FY24):

- Fine Art & Hobby – 17%

- Ink & Adhesives – 5%

- Office & Scholastic – 28%

- Paper Stationery – 15%

- Technical Instruments – 7%

- Writing Instruments – 28%

Essentially, the company sells everything from crayons to fountain pens. But lately, its canvas has been blotched by sluggish growth — and the Japanese parent is clearly getting the blues.

4. Financials Overview

| Metric | Q2FY26 (Latest) | Q2FY25 (YoY) | Q1FY26 (QoQ) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue (₹ Cr) | 174.4 | 172.5 | 227.4 | +1.1% | -23.3% |

| EBITDA (₹ Cr) | 16.1 | -7.6 | 19.6 | +312% | -17.8% |

| PAT (₹ Cr) | 7.86 | -10.63 | 10.06 | +174% | -21.9% |

| EPS (₹) | 0.78 | -1.06 | 1.00 | — | -22% |

Commentary:

When your revenue growth is 1% but PAT jumps 174%, that’s not magic — that’s accounting redemption. Operating margin at 9.25% is an improvement from negative territory a year ago, but the QoQ dip reminds us the back-to-school season didn’t save the day.

5. Valuation Discussion – Fair Value Range Only

Let’s do the math, not the guesswork.

- Current Price: ₹95.7

- EPS (TTM): ₹1.81

- P/E: 52.9×

Method 1: P/E-based

Assuming the industry median P/E is 39.4×, a fair range would be:

→ Lower band: 39.4 × 1.81 = ₹71

→ Upper band: 52.7 × 1.81 = ₹95

Method 2: EV/EBITDA

- EV: ₹944 Cr

- EBITDA (TTM): ₹49 Cr

→ EV/EBITDA = 19×

If fair industry range = 15–20×, fair value = ₹78–₹104

Method 3: DCF (Simplified)

Assume FCF = ₹18 Cr (FY25 ops), growth 6%, discount rate 10%

DCF Range = ₹80–₹100 per share

🎯 Fair Value Educational Range: ₹75 – ₹100 per share

Disclaimer: This fair value range is for educational purposes only and not investment advice. Also, if you use this to buy crayons, we support that fully.

6. What’s Cooking – News, Triggers, Drama

Oh boy, Kokuyo Camlin has had more boardroom drama than a school election.

- Forensic Saga: PwC found a ₹22.7 crore inventory fraud, where employees and job workers “creatively” adjusted stock levels. The company took a full write-off in FY25, and management swears there’s “no further loss expected.” We’ll