1. At a Glance

When a company sells bothpigmentsanddetergentwhile also running aBPO, you know things are going to get delightfully weird. Welcome toUltramarine & Pigments Ltd, a south-Indian concoction of chemistry, colour, and call-centres, with a market cap of ₹1,288 crore and a quarterly profit that just about scrubs its way into the green zone — ₹19.4 crore in Q2 FY26 on ₹196 crore revenue.

At ₹441 a share, the stock’s P/E is a scrubbed-clean 16.2, below the industry average of 22 — making it cheaper than your favourite detergent brand’s refilled pouch. The return on equity? 7.99%, which means the business earns less on its capital than a Tamil Nadu FD auntie. ROCE stands at 10.4%, showing they work hard, but the financial bubbles pop quickly.

The company’s operating profit margin (OPM) floats around 17%, and debt-to-equity ratio at 0.08 means it’s virtually debt-free. It’s like a desi soap that doesn’t foam much but still cleans the balance sheet. Over the last 3 months, the stock’s slipped -14.3%, but hey — even the cleanest companies occasionally slip on their own surfactant.

2. Introduction

Ultramarine & Pigments is the kind of company that sounds like a chemical engineer’s fantasy but behaves like a Chennai-based family business that refuses to give up its Sunday washing habits.

Founded way back when the word “surfactant” wasn’t even a Scrabble word in India, this smallcap player now juggles three oddly connected segments:Pigments (32%), Surfactants (59%), and IT/BPO services (9%). Yes, the same company that makes the blue in your washing powder also takes your customer care calls. Talk about vertical integration in spirit.

In the latest quarter endingSeptember 2025, Ultramarine clocked ₹196 crore in revenue, aYoY growth of 21.9%, while net profit rose modestly by3.92%. The company’s revenue mix has tilted slightly towards pigments — a high-margin business that’s glowing brighter thanks to their Naidupeta expansion — while the soap suds (surfactants) are stabilising after a foamy ride in FY22–24.

But Ultramarine isn’t your average colour maker. It also has wind turbines in Tamil Nadu, a 20% stake in Thirumalai Chemicals, and enough family trusts in its shareholding to make a genealogist nervous.

If you think “Blue is the Warmest Colour,” Ultramarine says “Blue is the Most Diversified Business Model.”

3. Business Model – WTF Do They Even Do?

Ultramarine & Pigments Ltd operates inthree primary divisions:

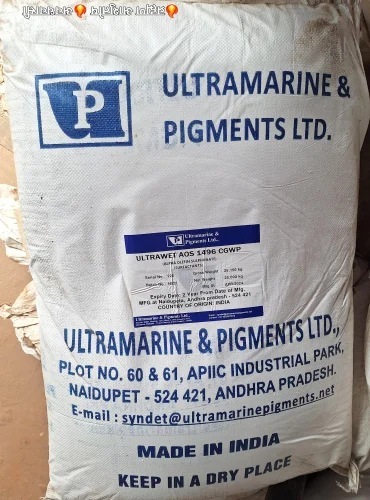

- Pigments Division (32% of FY23 revenue):This is the blue heart of the business — manufacturingultramarine blue pigmentsused in detergents, plastics, paints, inks, and cosmetics. The Naidupeta plant (capacity 1,500 MT) has already hit 70% utilisation, churning out premium pigments that promise better margins. Phase-2 expansion of 2,250 MT is ongoing with ₹80 crore capex — because apparently, blue is the new green.

- Surfactants Division (59% of FY23 revenue):They produce surfactants and intermediates for FMCG players across South India. Think of it as the raw material behind the sparkle of your detergent ad. The newsulphonation plant at Naidupetafaced some raw material hiccups in FY23 but is expected to lather up nicely in FY24–26. They also sell detergent under their own brand —“OOB”, a name so mysterious it sounds like a Tamil superhero.

- IT & BPO Division (9% of FY23 revenue):Yes, amidst acids and anionic agents, Ultramarine runs an IT arm offering business process outsourcing services. Somewhere in Chennai, a call centre employee might be helping a detergent buyer track his pigment shipment. It’s diversification — or confusion — at its finest.

They also dabble inwind energy (4.3 MW across Tamil Nadu), generating 61.84 lakh units last year, with 80% used captively. Green energy powering blue chemistry — sustainability or just poetic coincidence? You decide.

4. Financials Overview

| Metric | Latest Qtr (Sep 2025) | Same Qtr Last Year (Sep 2024) | Previous Qtr (Jun 2025) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | ₹196 Cr | ₹161 Cr | ₹184 Cr | 21.9% | 6.5% |

| EBITDA | ₹32 Cr | ₹27 Cr | ₹32 Cr | 18.5% | 0.0% |

| PAT | ₹19.4 Cr | ₹19.0 Cr | ₹20.0 Cr | 3.9% | -3.0% |

| EPS (₹) | 6.63 | 6.38 | 6.91 | 3.9% | -4.0% |

Commentary:Steady sales growth but profit plateaued — like your washing machine that hums fine but doesn’t spin faster. The EBITDA margin held around 16%, showing resilience amid raw material volatility. PAT margin at ~10% is respectable for a chemical-cum-BPO enterprise.

At an annualized EPS of ₹26.5, the

P/E ratio sits around 16.6, which isn’t expensive, but neither is it bargain-bin soap.

5. Valuation Discussion – Fair Value Range

Let’s crunch some clean numbers.

(a) P/E Approach:Industry average P/E = 22Company P/E = 16.2Annualized EPS = ₹27.2

Fair value range = 27.2 × (16–22) =₹435 – ₹598

(b) EV/EBITDA Method:EV/EBITDA = 9.49EBITDA (TTM) = ₹128 CrEnterprise Value = ₹1,313 CrAssume fair range 8x–11x → EV = ₹1,024 – ₹1,408 CrMinus net debt (₹89 Cr – ₹15 Cr cash) ≈ ₹74 Cr→ Equity value ≈ ₹950 – ₹1,334 CrPer share = ₹325 – ₹455

(c) DCF (Simplified Educational Estimate):Assume FCF growth 10% for 5 years, WACC 10%, terminal growth 3% → intrinsic range ₹400–₹480

✅Fair Value Range (Educational): ₹400 – ₹500 per share

Disclaimer:This fair value range is for educational purposes only and not investment advice. If you wash your hands with this information, the lather is entirely yours.

6. What’s Cooking – News, Triggers, Drama

- Q2 FY26 Results:Unaudited consolidated results for the half-year show steady margins and a modest 3.9% YoY profit uptick.

- Capex Mania:New pigment phase-2 capacity (2,250 MT) got ₹80 crore backing. Specialty chemical project worth ₹25 crore and inorganic pigment unit (₹37 crore) under completion.

- Thirumalai Chemicals Saga:Ultramarine owns ~20% in Thirumalai and has agreed to invest ₹45 crore in its preferential allotment (announced Oct 2025). If Thirumalai’s acid business booms, Ultramarine’s dividends might finally make investors smile.

- Land Grab (the good kind):In Dec 2024, they acquired32.12 acresfor future expansion. No housing colony plans — yet.

- Wind Power:Two new wind turbines operational; they now self-supply a significant chunk of plant electricity.

- MoU with Tamil Nadu Govt:Signed for ₹150 crore expansion; yes, the state wants more of their blue dust.

So what’s cooking? Capex curry with a side of renewable chutney — served hot for FY26–27.

7. Balance Sheet

| Metric | Mar 2023 | Mar 2024 | Sep 2025 |

|---|---|---|---|

| Total Assets | ₹881 Cr | ₹1,076 Cr | ₹1,290 Cr |

| Net Worth | ₹736 Cr | ₹900 Cr | ₹1,063 Cr |

| Borrowings | ₹75 Cr | ₹79 Cr | ₹89 Cr |

| Other Liabilities | ₹70 Cr | ₹97 Cr | ₹138 Cr |

| Total Liabilities | ₹881 Cr | ₹1,076 Cr | ₹1,290 Cr |

Commentary:

- The balance sheet looks like a freshly