🟢 At a Glance:

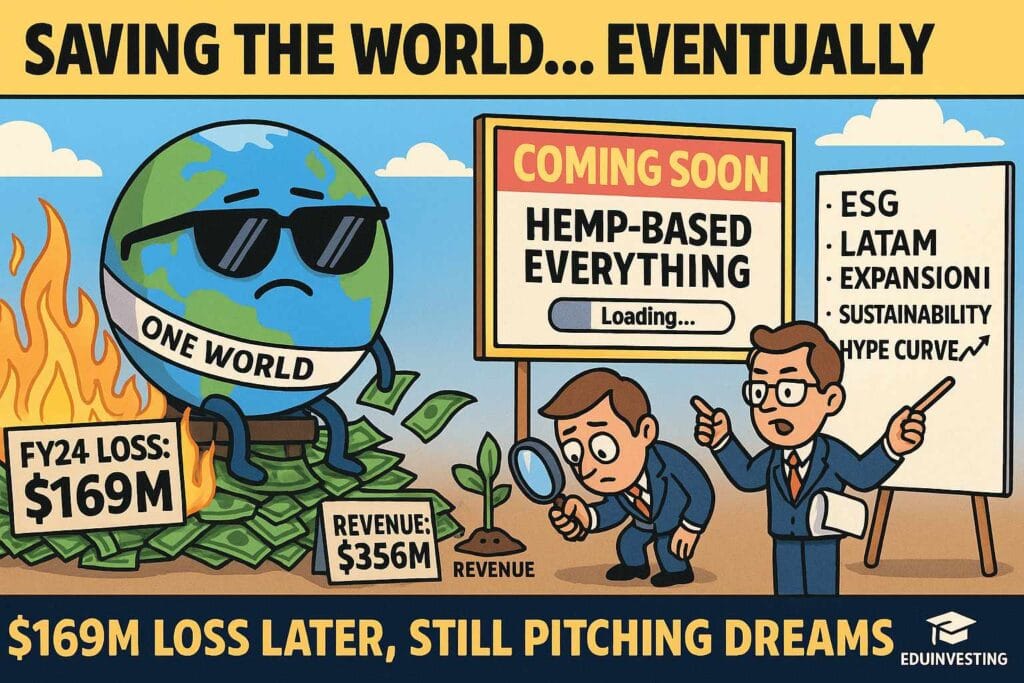

One World Products, Inc. (OWPC) just filed its 10-K for FY2024, and it’s a masterclass in optimism:

- 💵 Revenue: $356.7 million

- 🔴 Net Loss: $(169.2) million

- 💸 Operating Loss: $(165.1) million

- 💰 Cash Balance: $112.9 million

- 🔥 Cash Burn from Operations: $(133.7) million

- 🧾 R&D Spend: $108.7 million

- 🎩 SG&A: $217.6 million — because somebody’s gotta pay for those “brand activations”

The vibes are global, the balance sheet is bleeding, and the business model is apparently saving the planet… eventually.

💼 What They Actually Do

One World Products operates in the cannabis-adjacent, sustainability-meets-global-impact space.

They

love buzzwords like:

- “Global Supply Chain Sustainability”

- “Joint Ventures in Latin America”

- “Strategic Innovation in Hemp-Based Plastics”

And yet, the only green in this report was… the cash they burned.

🧾 FY24 Financial Breakdown

| Metric | FY24 | Notes |

|---|---|---|

| 💸 Revenue | $356.7M | No major YoY growth noted |

| 🔻 Net Loss | $(169.2)M | Loss > 47% of revenue |

| 🔍 Operating Loss | $(165.1)M | Cost base too fat |

| 📦 Gross Margin | ~46% | Not bad for a startup |

| 💼 SG&A | $217.6M | Sus af. What’s in there? |

| 🧪 R&D | $108.7M | Not stingy on innovation |

They’re running a

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member