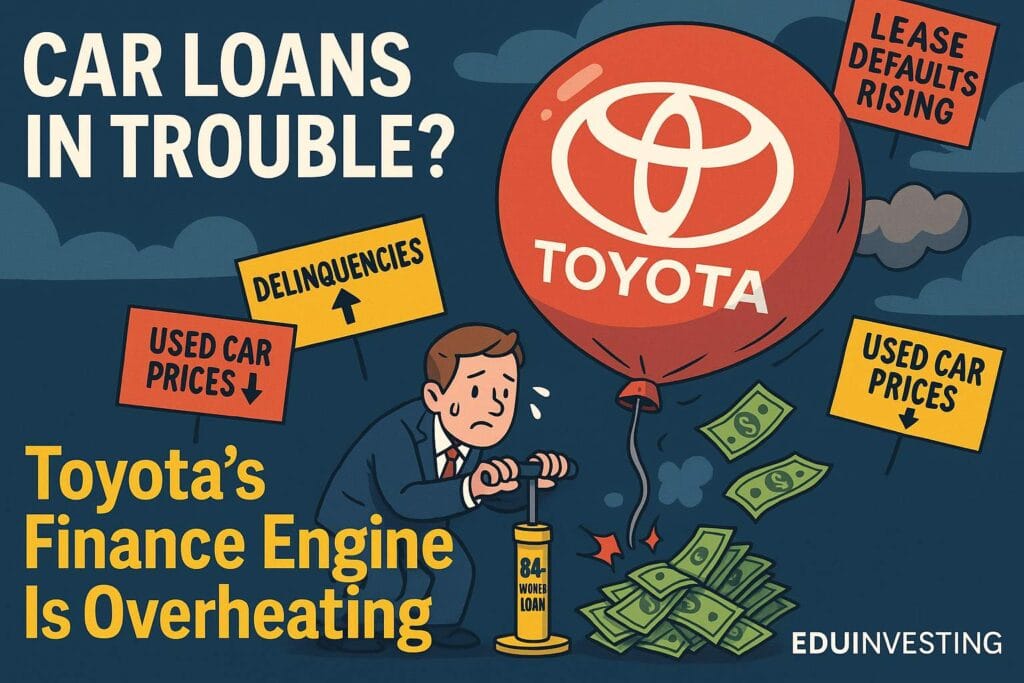

🧠 At a Glance:

Toyota’s car sales may run on engines, but its profits? Pure finance.

And now, Toyota Motor Credit Corporation (TMCC) — the silent lender behind those “0% APR” dreams — has filed its FY2025 10-K. Here’s what we found:

- 🔻 Net Income is down

- 📉 Delinquencies are up

- 💸 Loan book is ballooning

- 🏦 Borrowing costs are rising

Basically, TMCC is America’s biggest car dealership dressed up as a bank — and 2025 might be the year the gears start grinding.

🏢 About Toyota Motor Credit Corporation (TMCC)

- Subsidiary of Toyota Financial Services, operating in the U.S.

- Provides:

- Vehicle loans and leases to retail customers

- Dealer financing for Toyota and Lexus

- Securitization of auto receivables (because debt = magic 🪄)

- Based in Plano, Texas (yeehaw meets yen)

💼 Who Runs the Money Engine?

| Key Executives | Role |

|---|---|

| Mark Templin | CEO of Toyota Financial Services Americas |

| Scott Cooke | CFO |

| Christopher Ballinger (earlier) | Strategic Finance |

These aren’t your average car dealership managers. These are quant-laced finance pros running a

multi-billion dollar auto-finance empire.

💰 FY2025 Financial Highlights

| Metric | FY2024 | FY2025 | % Change |

|---|---|---|---|

| Net Revenues | $5.82B | $5.61B | 🔻 -3.6% |

| Net Income | $1.62B | $1.35B | 🔻 -16.6% |

| Total Assets | $148B | $153.7B | 🔼 +3.9% |

| Loan Portfolio | ~$116B | ~$120B | 🔼 +3.4% |

| Delinquency Rate (60+ days) | 0.33% | 0.52% | ⚠️ +57% |

Yes, the profits are down, but the real shocker? Delinquencies are up 57% YoY.

That’s not a red flag. That’s a Toyota-sized airbag warning light.

📉 Why Did Profits Shrink?

- 🧾 Higher Cost of Funds: TMCC relies on short- and medium-term borrowing. With the Fed refusing to cut rates, their funding cost jumped.

- 🏚️ More Delinquencies: Inflation-hit Americans are struggling to pay for their over-financed SUVs. Who knew a $56,000 Camry wasn’t affordable?

- 📊 Residual Value Woes: Used car prices have cooled, hurting lease returns and resale profits.

- ⚖️ Provisioning for Credit Losses: They’re

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member