🟢 At a Glance:

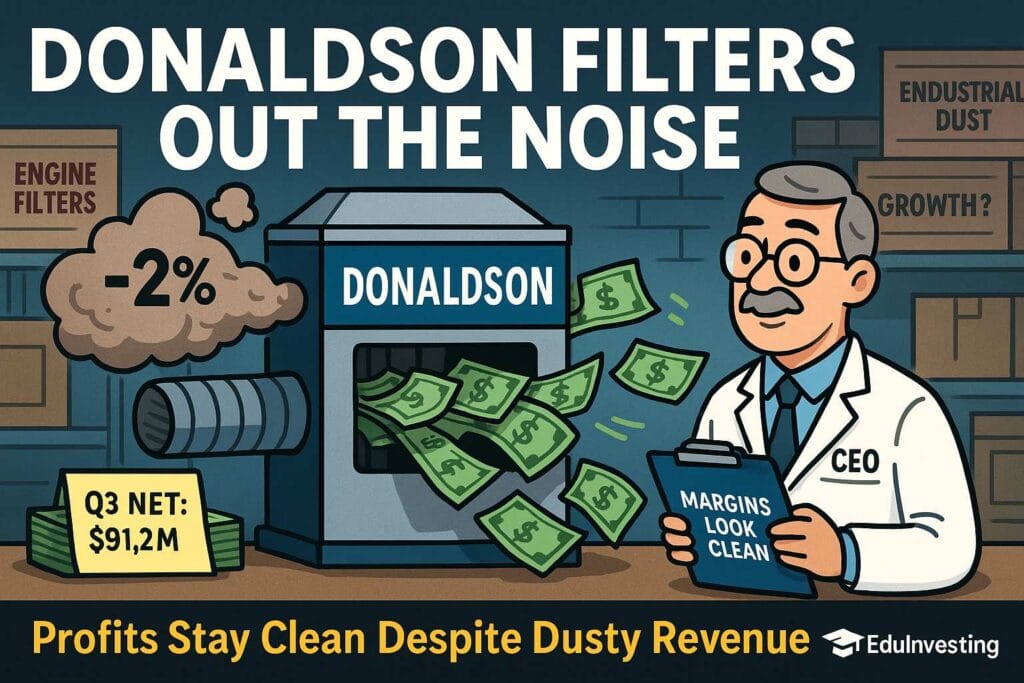

Donaldson Company, the air filtration giant, just dropped its Q3 FY25 earnings — and while the numbers aren’t explosive, they’re cleaner than your A/C vent after one of their premium filters.

- 🧾 Revenue: $879.5 million

- 💸 Net Income: $91.2 million

- 📉 Operating Income: $123.1 million

- 💰 EPS (Diluted): $0.75

- 🟩 Gross Margin: ~34.9%

- 🔻 YoY revenue decline of 2.1%

- 🔺 Operating margin improved slightly vs prior quarters

In short: revenue dipped, profit held steady, and management is still inhaling optimism.

💼 Business Breakdown:

| Segment | Revenue ($M) | YoY Change |

|---|---|---|

| Engine Products | 547.4 | ▼ 3.2% |

| Industrial Products | 332.1 | ▼ 0.2% |

So basically, trucks got dusty and factories kept coughing.

🔍 Regionally

Speaking:

- U.S. and Europe: held relatively steady

- APAC & Latin America: not the growth engines this time

- Currency impact? Minimal. Management cleverly said “unfavorable FX impact” and moved on.

🧠 Management’s Script Highlights (Translated)

“Sales declined primarily due to lower volumes…”

🧠 Translation: Customers didn’t need as many filters. Or didn’t know they did.

“Pricing remained strong…”

🧠 Translation: We charged more, sold less, and the math still worked.

“We’re confident in our long-term strategy.”

🧠 Translation: Please don’t ask us about the next quarter.

💼

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member