🟢 At a Glance:

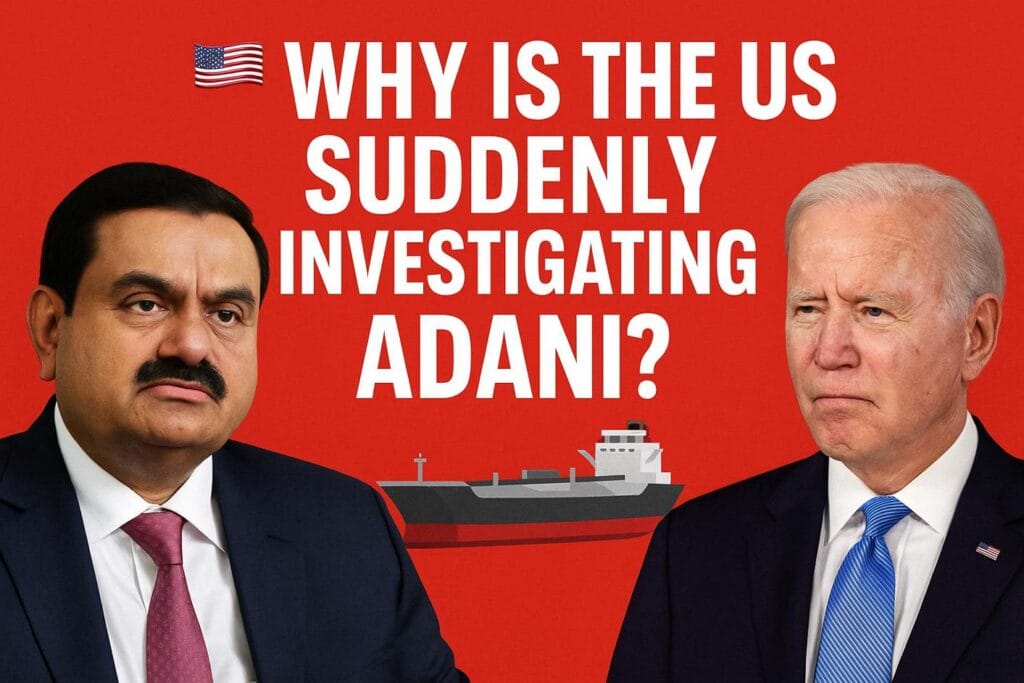

The United States just realized something: India’s richest man might’ve helped smuggle Iranian oil while smiling politely at Joe Biden’s climate summit. So now, America’s FBI-types are investigating LPG tankers that go invisible, bribe accusations involving $250 million, and a Gujarati port that allegedly became an international laundromat for sanctions-busting fossil fuels. Welcome to Season 2 of Adani vs The World — and this time, the villain is not Hindenburg.

🎬 Episode 1: Mundra to Manhattan – The Plot Thickens

In the opening scene:

- Seven shady ships

- Disappearing GPS signals

- Iranian oil wearing a fake moustache and entering Mundra Port like “Namaste, I am from Dubai”

The Wall Street Journal, which usually cares more about Elon Musk’s baby names than Indian ports, suddenly dropped a bomb:

“Adani Group under US scrutiny for sanctions violations related to Iranian fuel shipments.”

America’s reaction:

😡 “You helped Iran?”

Adani’s reaction:

😐 “What? Who? Me?”

🛢️ What the Hell Happened?

Let’s break this down Bollywood-style.

🎥 Plotline:

| Scene | Drama |

|---|---|

| 🛳️ Scene 1 | Oil is filled in Iran, but tankers go dark (literally – no signal) |

| 🛰️ Scene 2 | Ships spoof GPS to say “We’re in Oman bro!” while chilling in Bandar Abbas |

| 🧾 Scene 3 | Paperwork forged – oil becomes “Made in Iraq” |

| ⚓ Scene 4 | They dock at Mundra Port, Gujarat – a.k.a. Adani’s playground |

| 🏭 Scene 5 | Fuel unloaded, sold, and everyone pretends it’s totally normal |

If true, this makes Adani not just a billionaire, but a Bond villain with shipping lanes.

🔥 America’s Mood Right Now: “Who Let This Slide?”

Enter:

- US Department of Justice

- Office of Foreign Assets Control (OFAC)

- Department of Homeland Security

All asking one thing:

“How the hell did Iranian oil end up in Gujarat looking like it had a Dubai passport?”

🧨 But Wait, There’s More: The $250 Million Bribe Bombshell

Oh yes. This is Season 2 because Season 1 already aired on US dockets.

🎬 In case you forgot:

- Gautam Adani & nephew Sagar Adani were named in a whistleblower complaint

- Allegedly paid $250 million in bribes

- To secure power contracts in Sri Lanka

- Then issued bonds in the US, without disclosing the corruption

Which basically means:

“Here’s some fraud. Now invest in us. Love, Adani.”

And now with IranGate 2.0?

It’s like Hindenburg lit the fire, and the US just found gasoline.

👨⚖️ What Happens If US Proves It?

This is not just another “activist short seller” story.

If the US finds Adani knowingly facilitated Iranian oil:

- 🚫 His companies could be