🟢 At a Glance

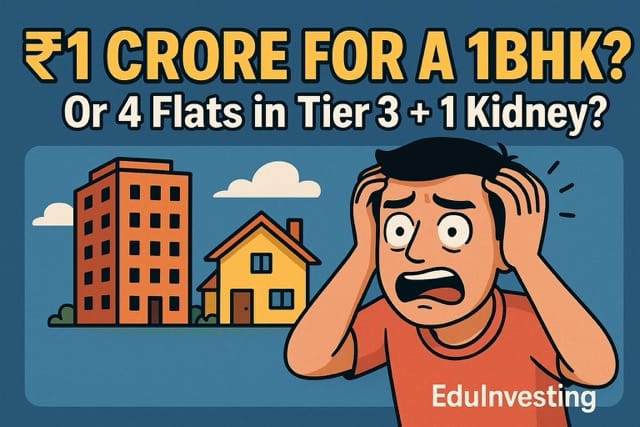

Yes, you read that right. A 1BHK flat in Mumbai is now priced at ₹1 crore. For the same amount, you could buy four 2BHKs in tier-3 cities and still afford to donate a kidney out of pure financial trauma. India’s housing market in 2025 has officially entered the “are you serious?” zone. But the real question is — why is this madness still selling out in minutes?

📦 The ₹1 Crore Flat Starter Pack

Let’s break down what you get in this ₹1 crore 1BHK:

| Feature | Reality Check |

|---|---|

| Carpet Area | 325 sq. ft (less than a Zoom call background) |

| View | Neighbour’s underwear on drying line |

| Parking | ₹15 lakh extra (for a Nano you don’t own) |

| Registration + GST | ₹8–10 lakh more (of course, above 1 cr) |

| Location | 2 km walk from the station, 3 km from society |

| Builder Promise | “Sea-facing” if you squint hard on the roof |

Meanwhile, in places like Nagpur, Indore, Bhopal, Siliguri, ₹1 crore can buy:

- 4 decent-sized 2BHKs

- 1 villa with a courtyard and a cow

- A plot of land large enough to start a cricket academy

- And you’ll

- still have money left for Uber Lux rides for a year

💡 Why the Hell Is Mumbai So Expensive?

Let’s be honest. Mumbai isn’t just selling you a flat. It’s selling:

- ✨ “Dreams”

- ☠️ False scarcity

- 🚇 False promises of metro connectivity

- 🤡 And a 5-year waiting period for possession

Here’s what’s driving it:

- Limited land: Because water on three sides and political paralysis on the fourth

- NRI demand: NRIs love investing in 2BHKs they never live in

- FOMO: People think prices only go up. They also thought Paytm was worth ₹2,100.

- Speculation: Every second “investor” in Mumbai is holding 3 flats, none of which he lives in

- Herd behaviour: “Amit just bought in Chembur, bro — we should too!”

🤯 The Real Cost of a ₹1 Cr Flat

Let’s calculate what you’ll pay monthly:

| Expense | Monthly ₹ |

|---|---|

| EMI (₹1 Cr @ 8.5%, 20 yrs) | ₹86,800 |

| Maintenance (avg ₹8/sq ft) | ₹2,600 |

| Parking EMI | ₹8,000 |

| Domestic help | ₹4,000 |

| Total Monthly Cost | ₹1,01,400 |

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member